All Blogs

PERFICIO

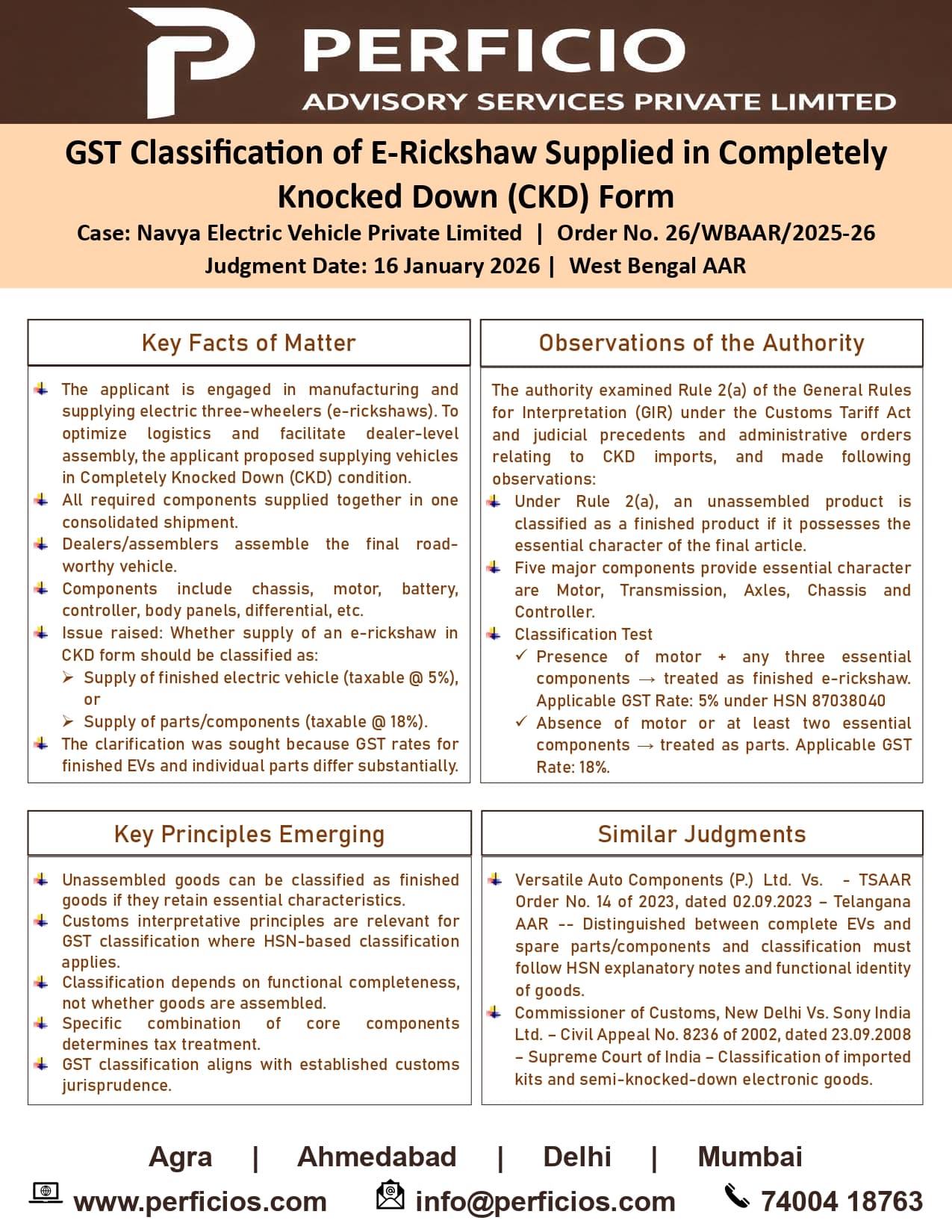

GST Ruling -- Classification of E-rickshaw supplied in Completely Knocked Down (CKD) form

PERFICIO

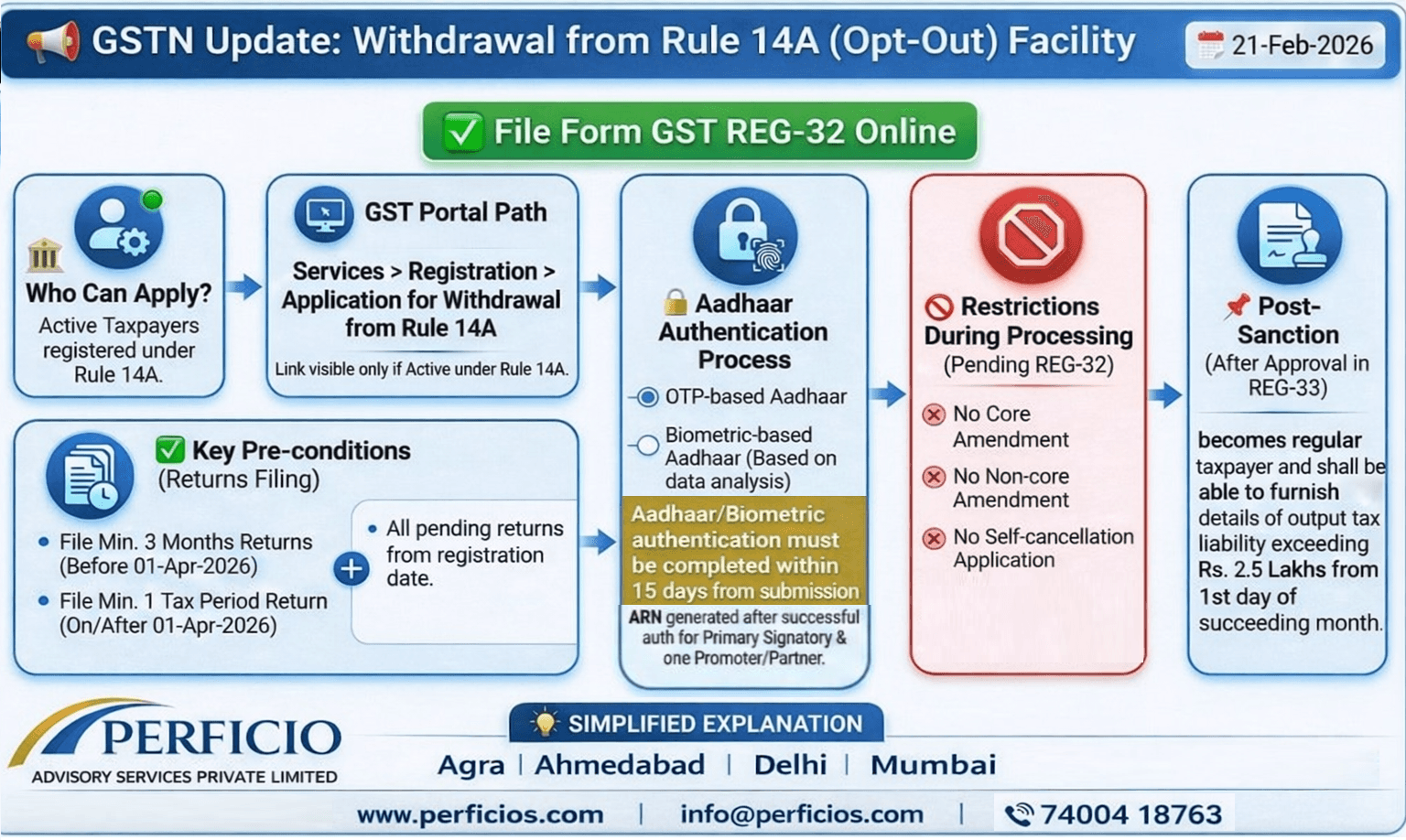

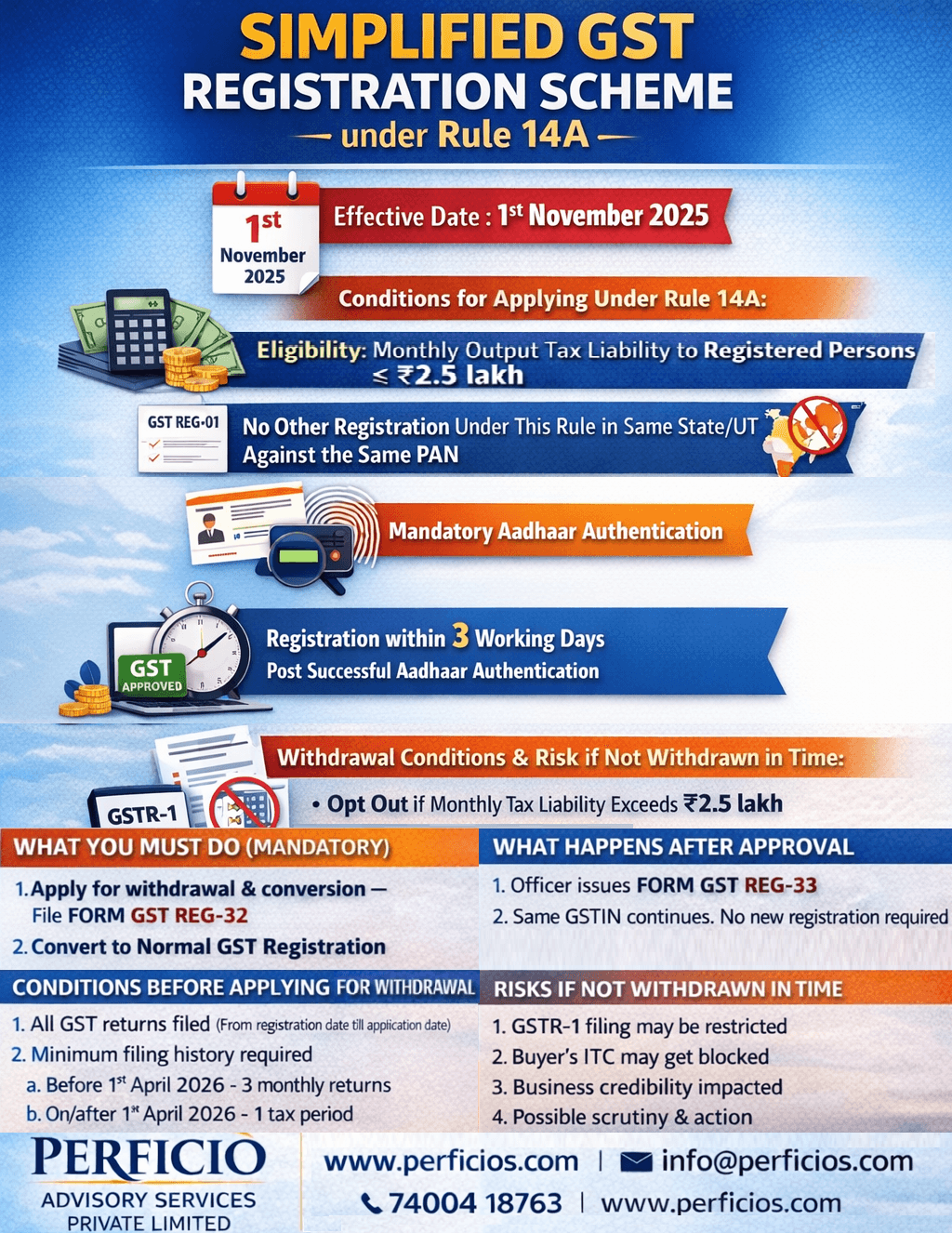

📢📢 GSTN Alert Withdrawal from Rule 14A (Opt-out) Facility

PERFICIO

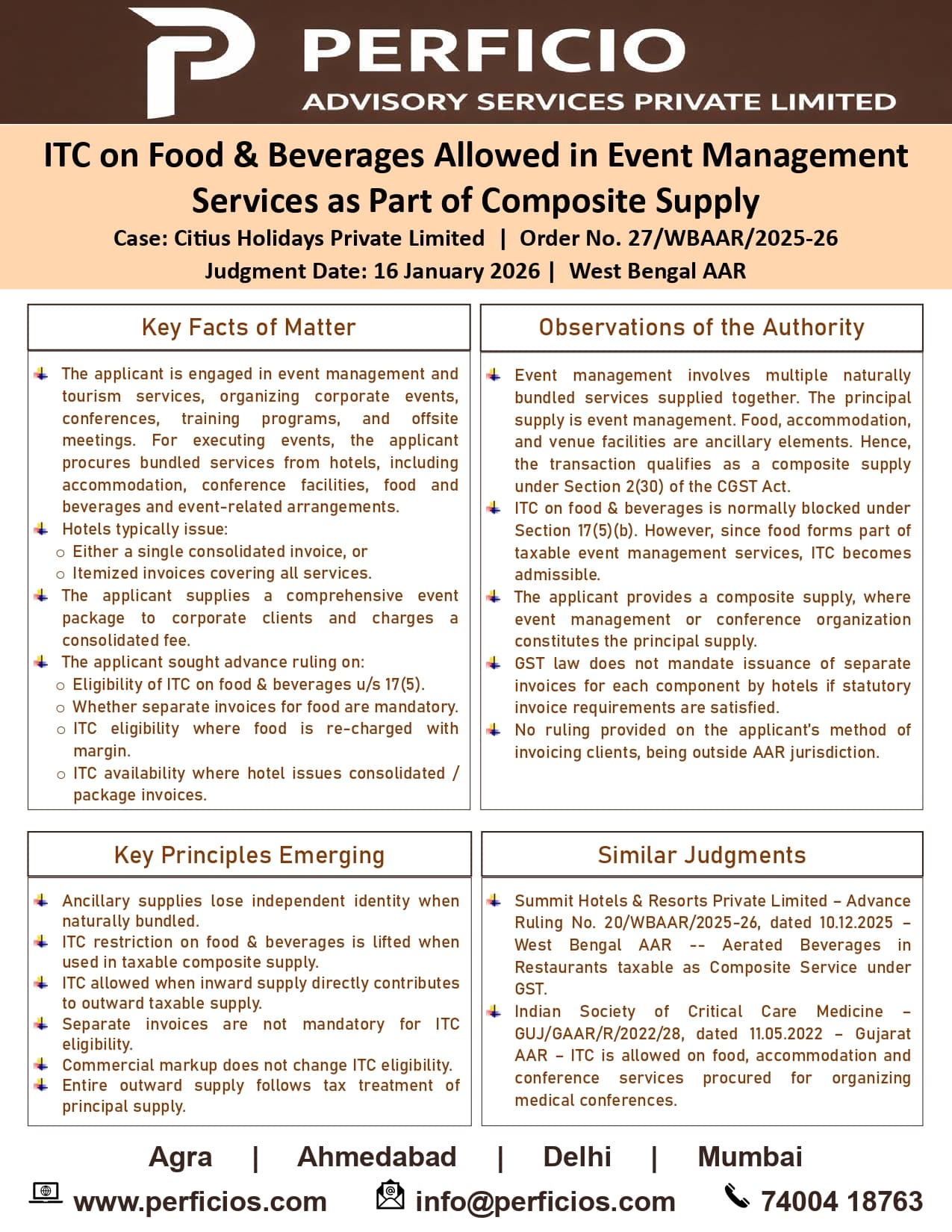

GST Ruling -- ITC on food & beverages allowed in Event management services as part of Composite Supply

PERFICIO

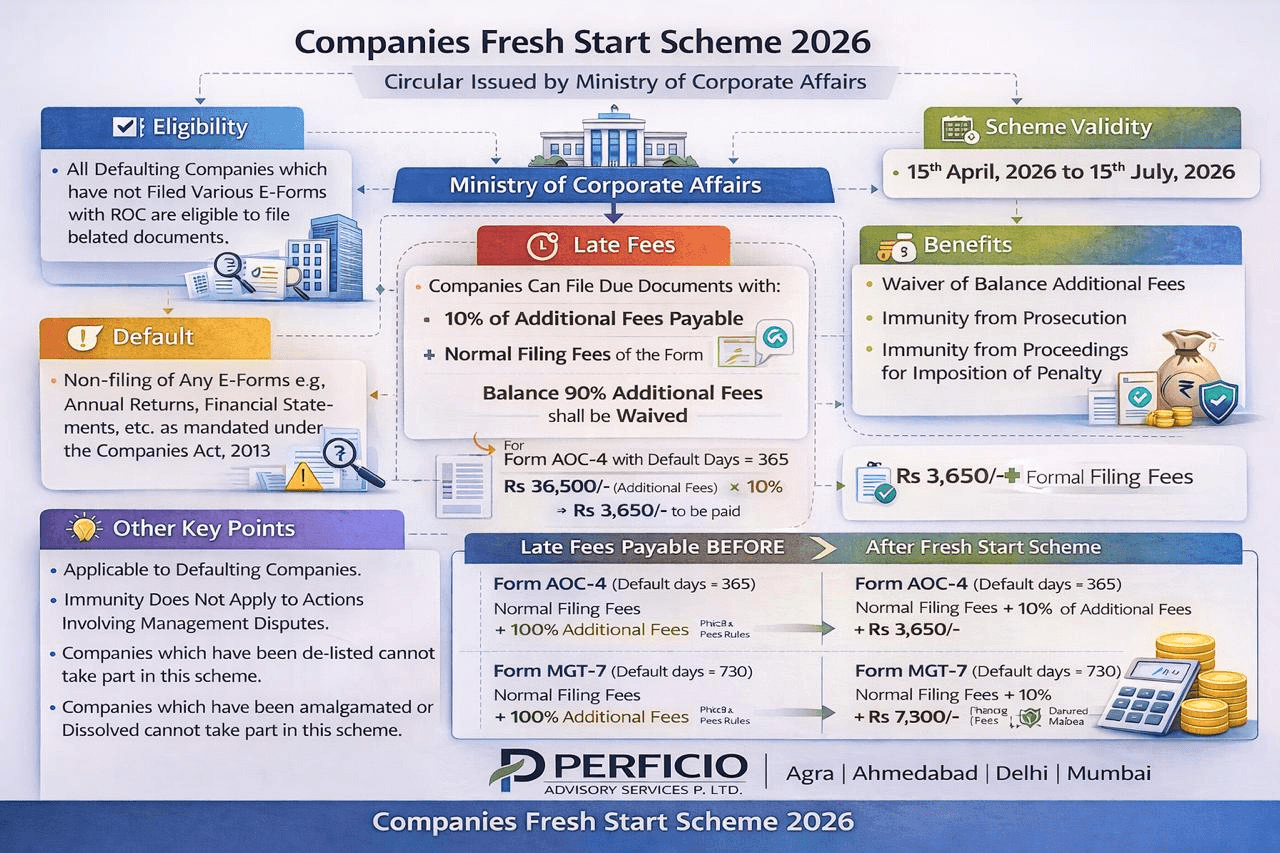

Companies Fresh Start Scheme 2026 -- Circular issued by Ministry of Corporate Affairs..

PERFICIO

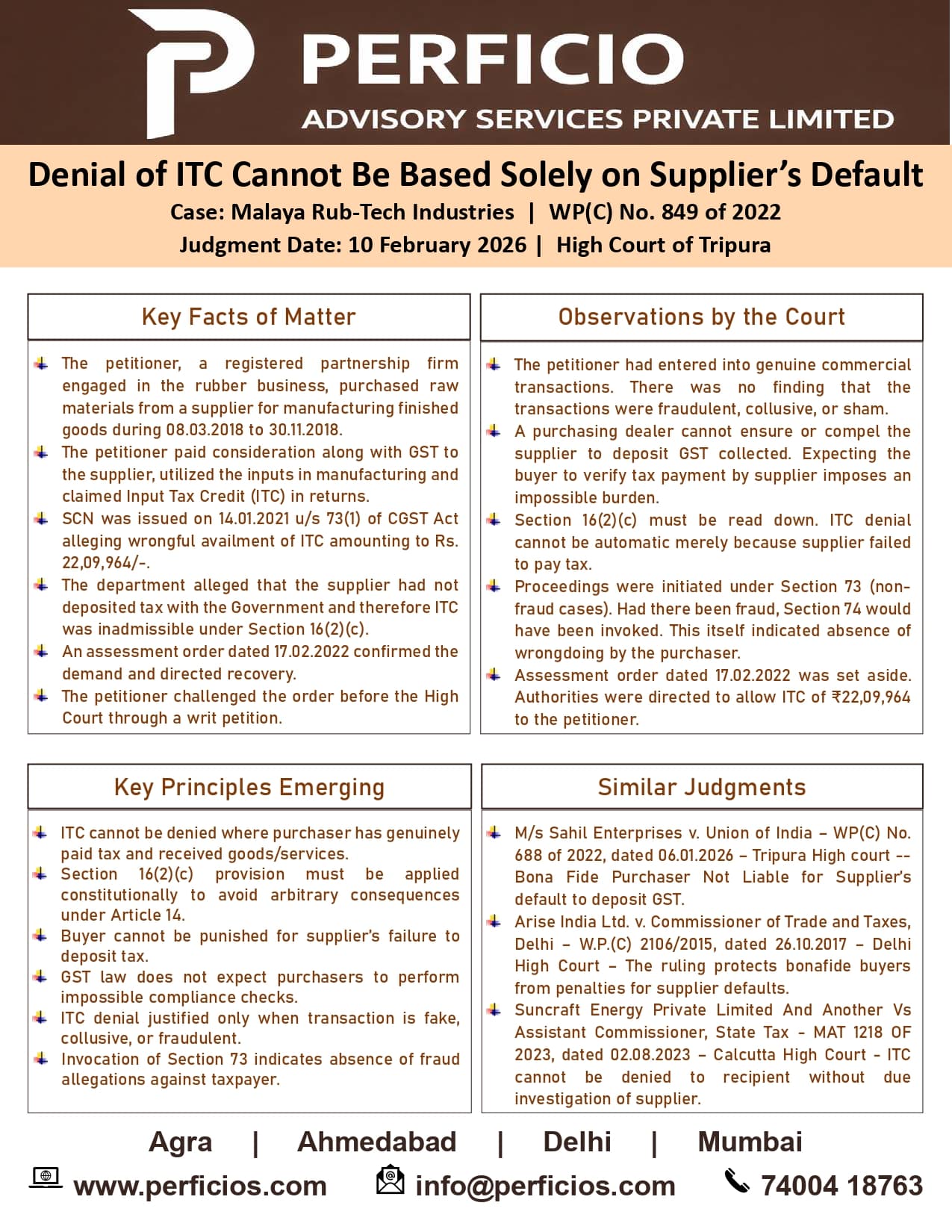

GST Ruling -- Denial of ITC cannot be based solely on /supplier's Default

PERFICIO

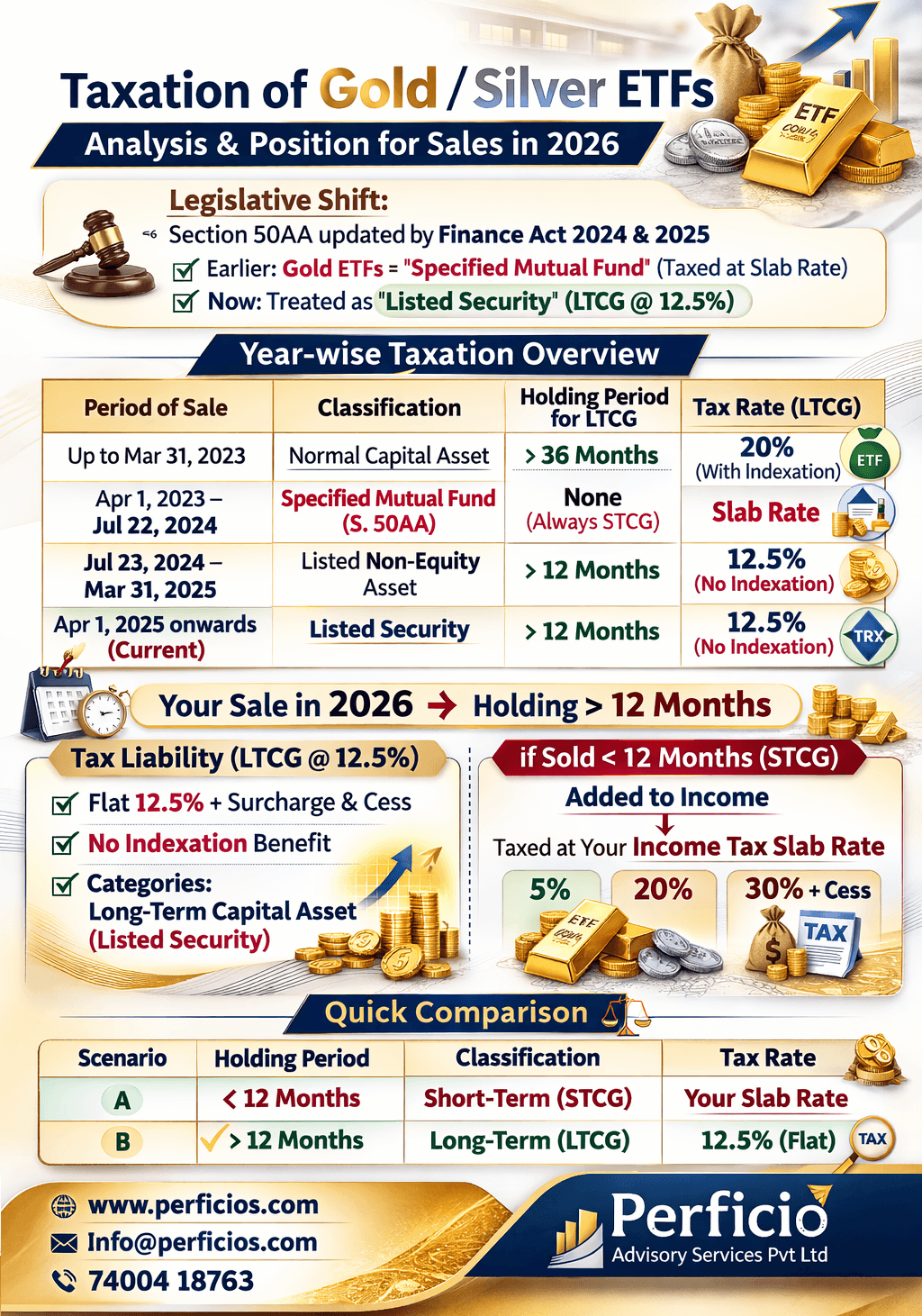

Taxation of Gold / Silver ETFs - Analysis & Position for Sales in 2026

PERFICIO

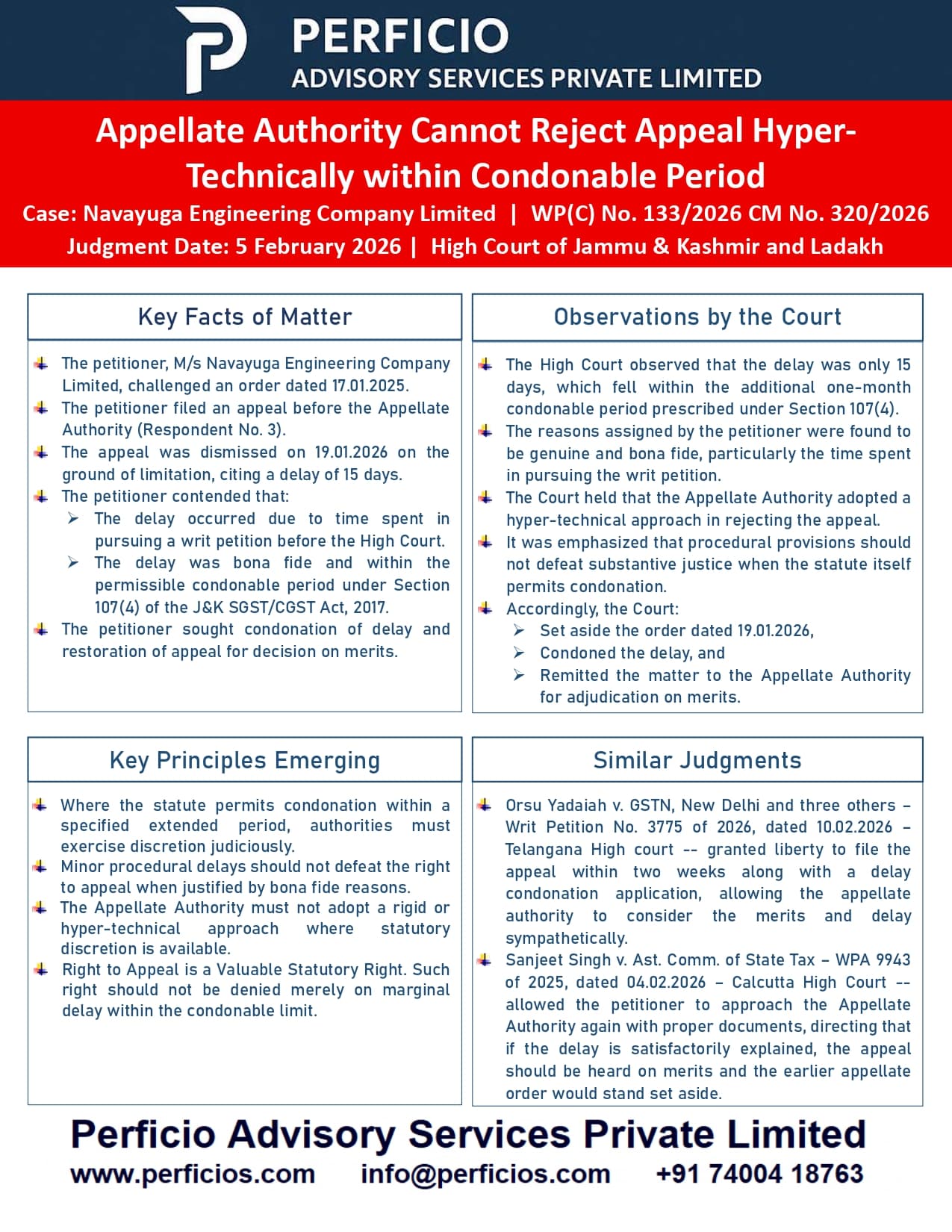

GST Ruling -- Appellate Authority cannot reject appeal Hyper-Technically within Condonable Period

PERFICIO

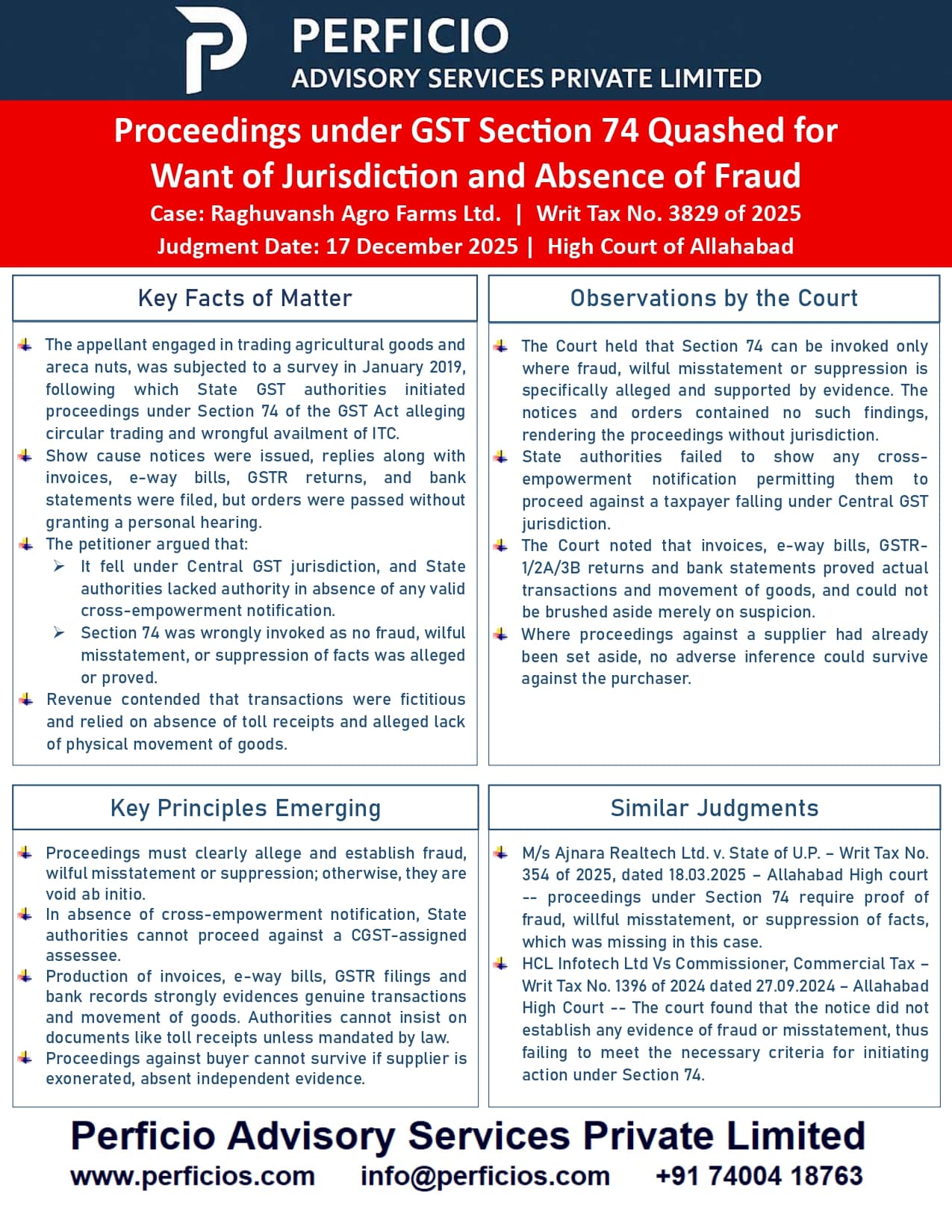

GST Ruling -- Proceedings under GST Section 74 quashed for want of Jurisdiction and Absence of Fraud !!!

PERFICIO

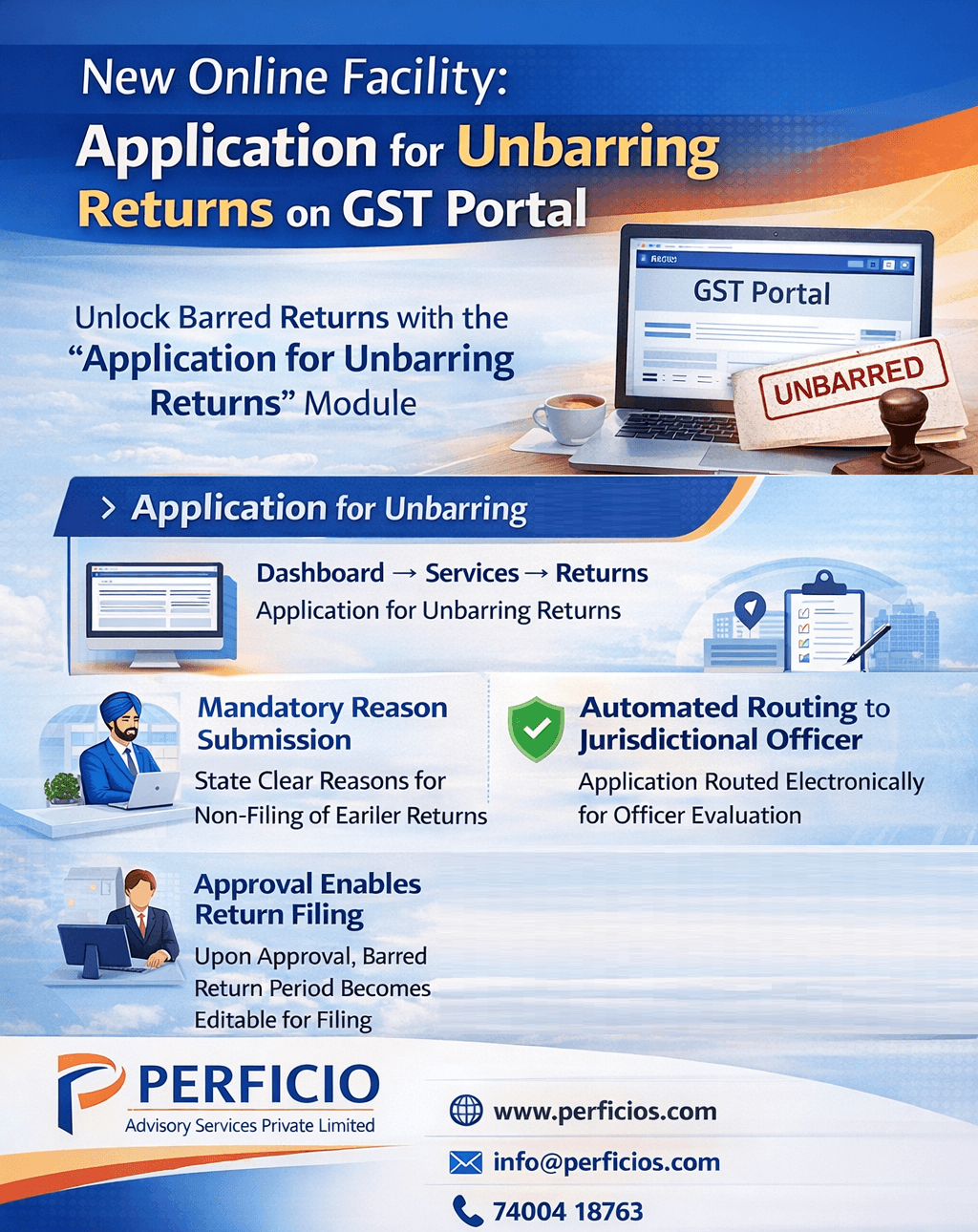

New Online Facility unveiled by GSTN !!! Application for Unbarring Returns on GST Portal...

PERFICIO

Simplified GST Registration Scheme under Rule 14A

PERFICIO

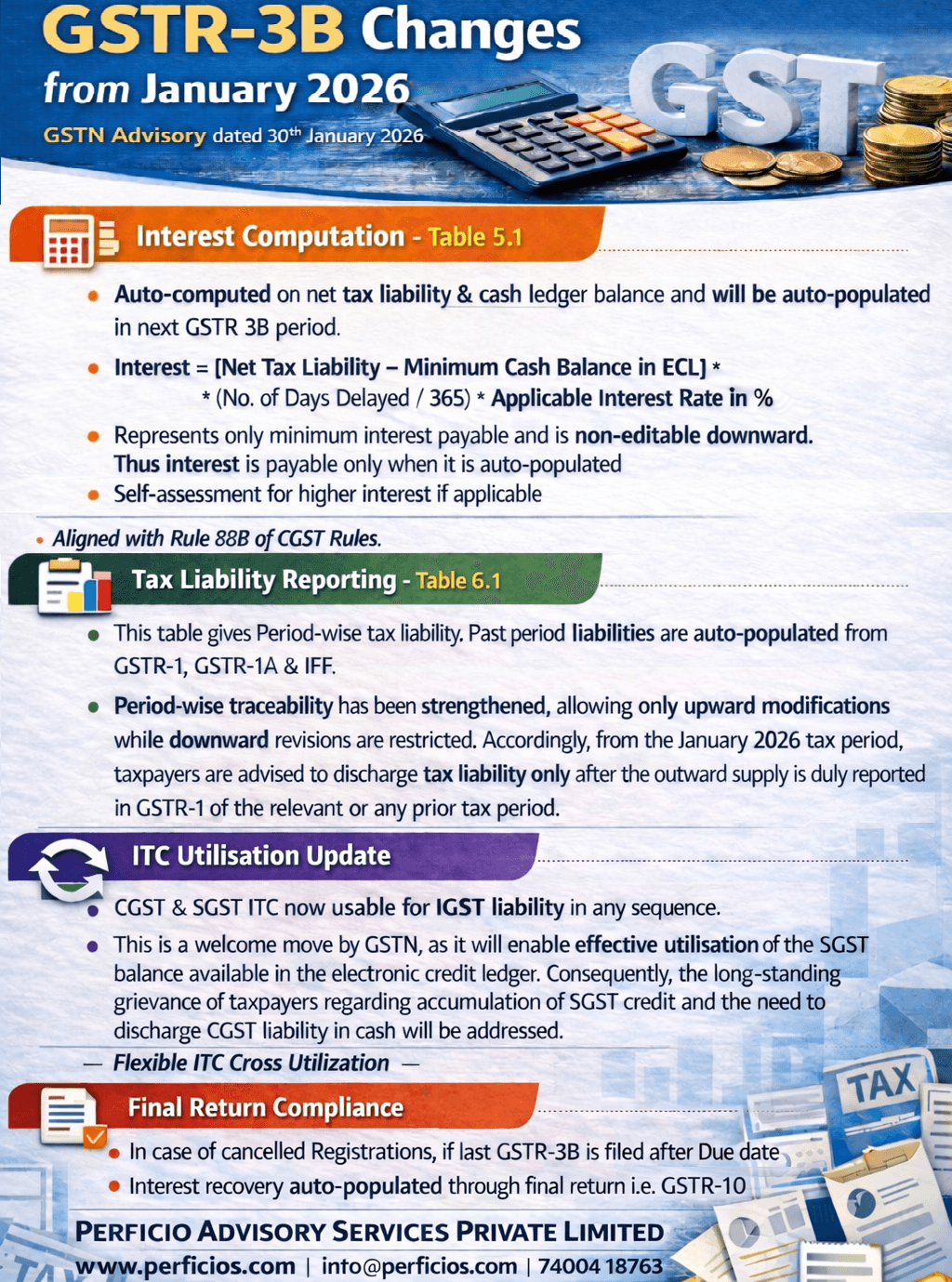

GSTN Advisory -- Changes in GSTR-3B and Interest Calculation

PERFICIO

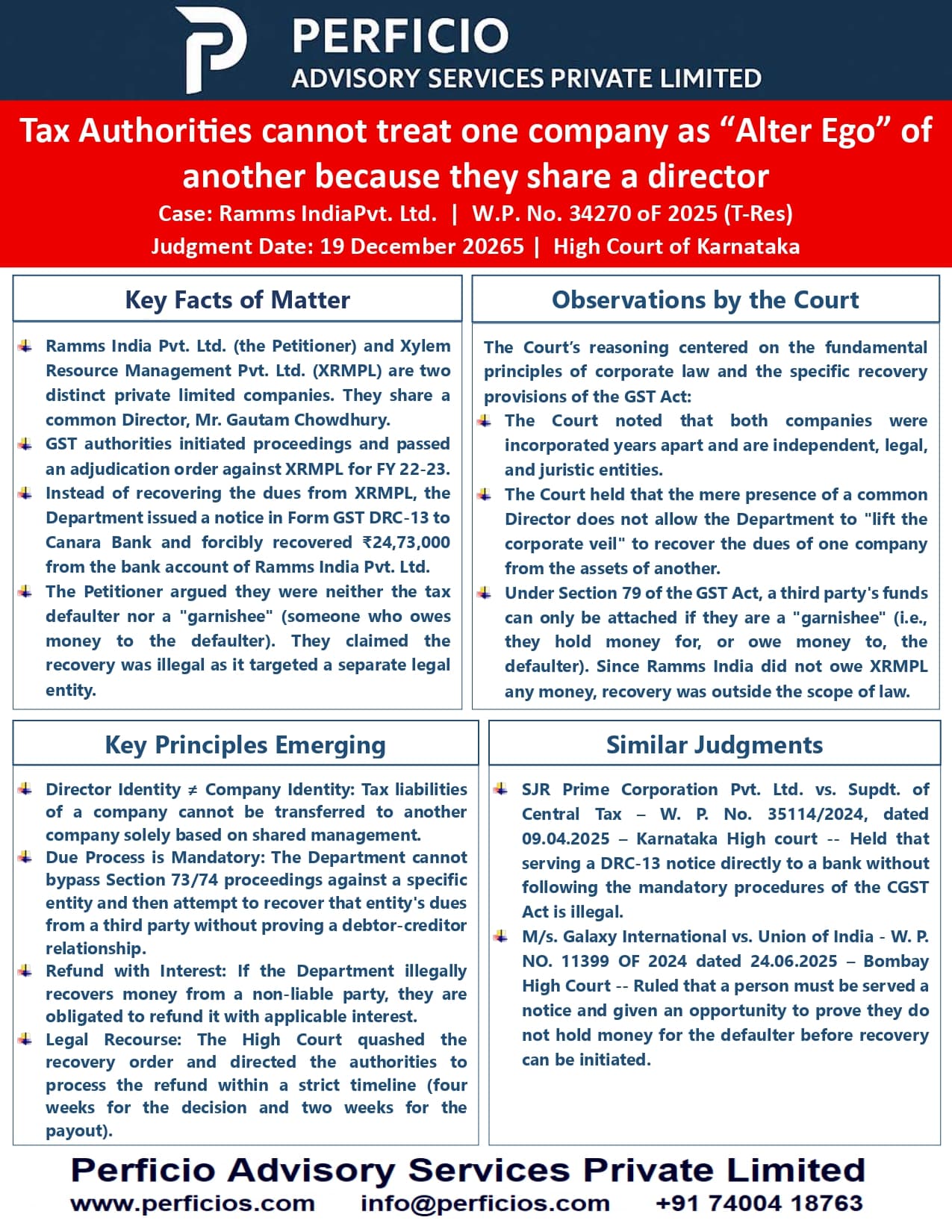

GST Ruling -- Tax Authorities cannot treat one company as "Alter Ego" of another because they share a director

PERFICIO

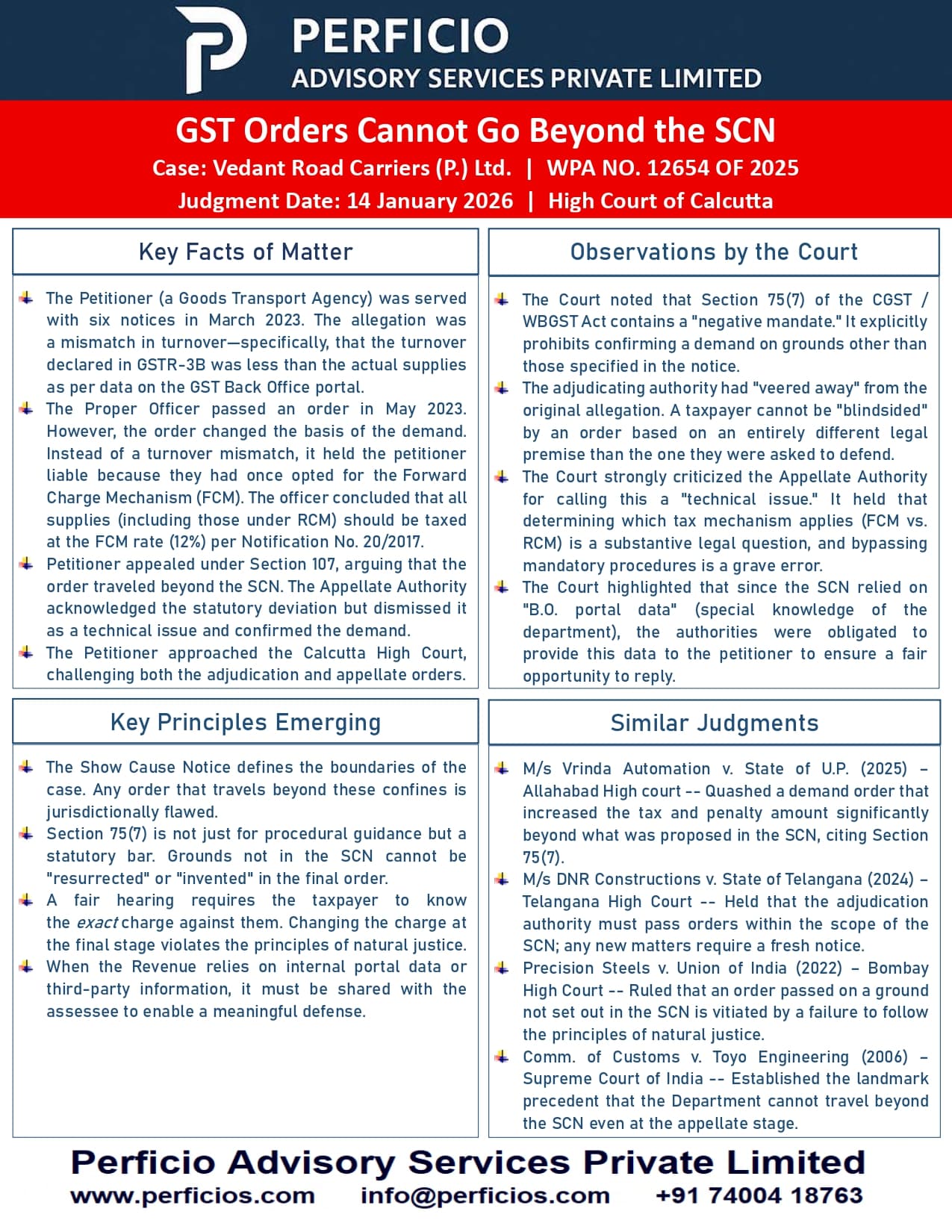

GST Ruling -- GST Orders cannot go beyond Show Cause Notice (SCN)

PERFICIO

GST Ruling -- Assigning long-term leasehold rights is transfer of immovable property, not a taxable service under GST

PERFICIO

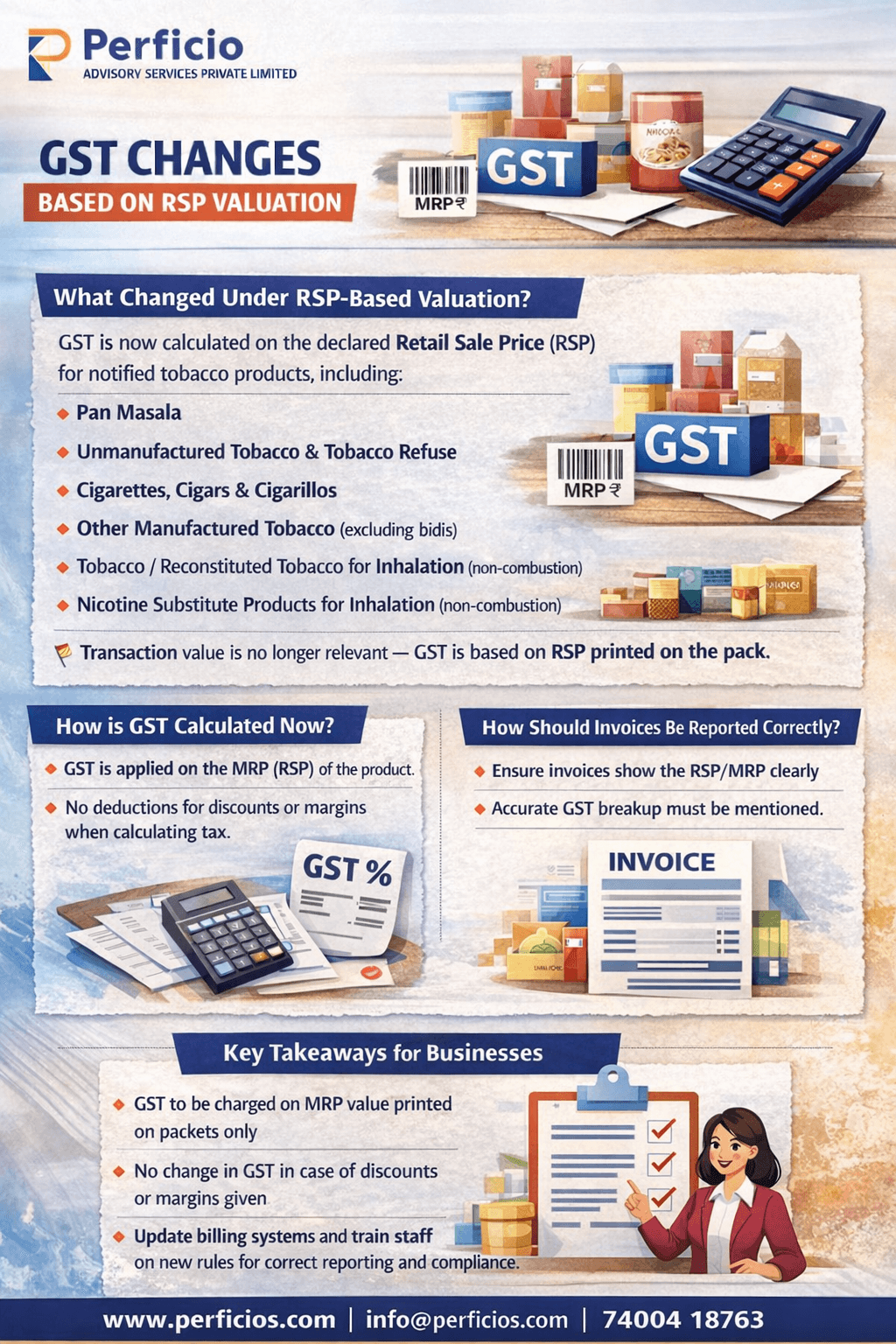

GSTN Advisory on RSP (Retail Sale Price) based Valuation

PERFICIO

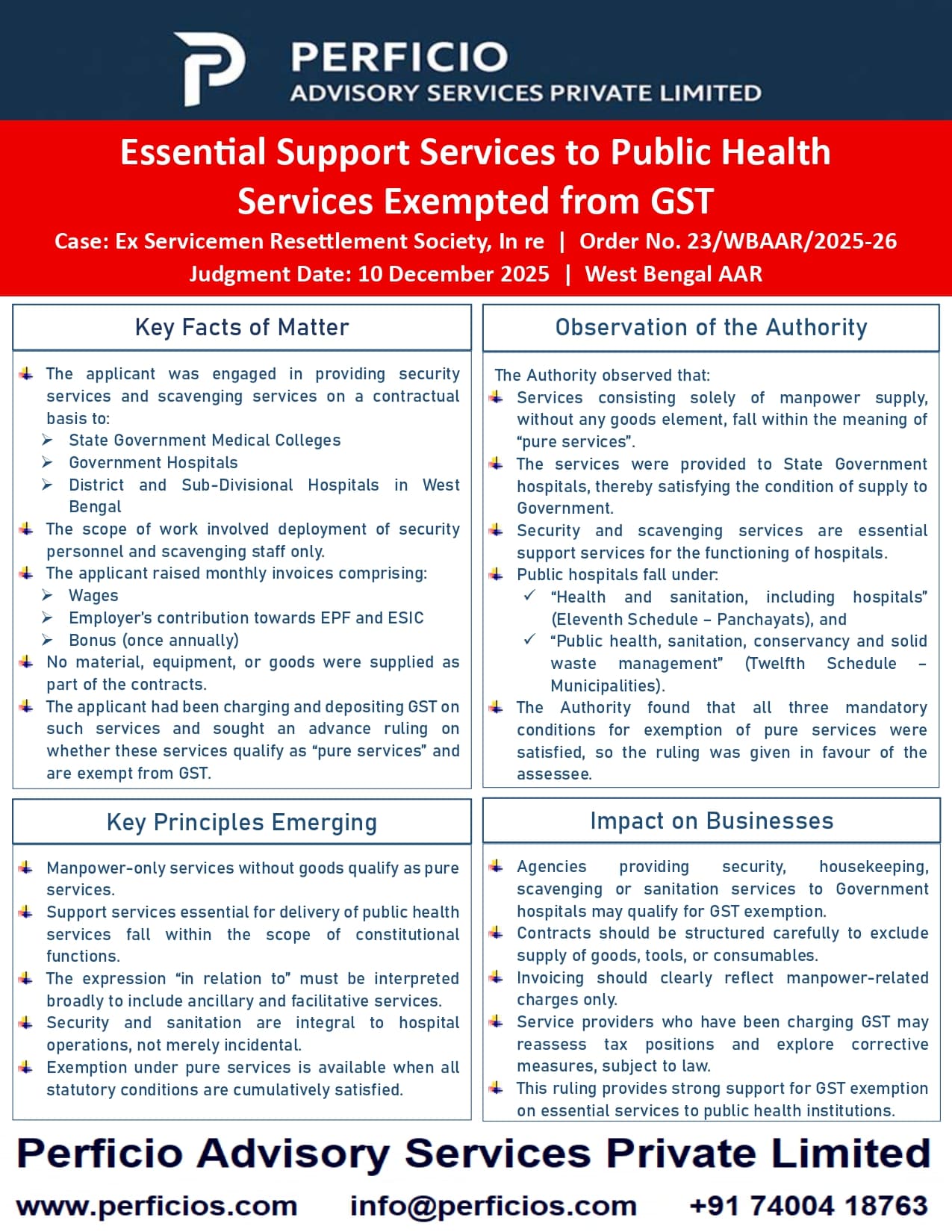

GST Advance Authority Ruling -- Essential Support Services to Public Health Services Exempted from GST

PERFICIO

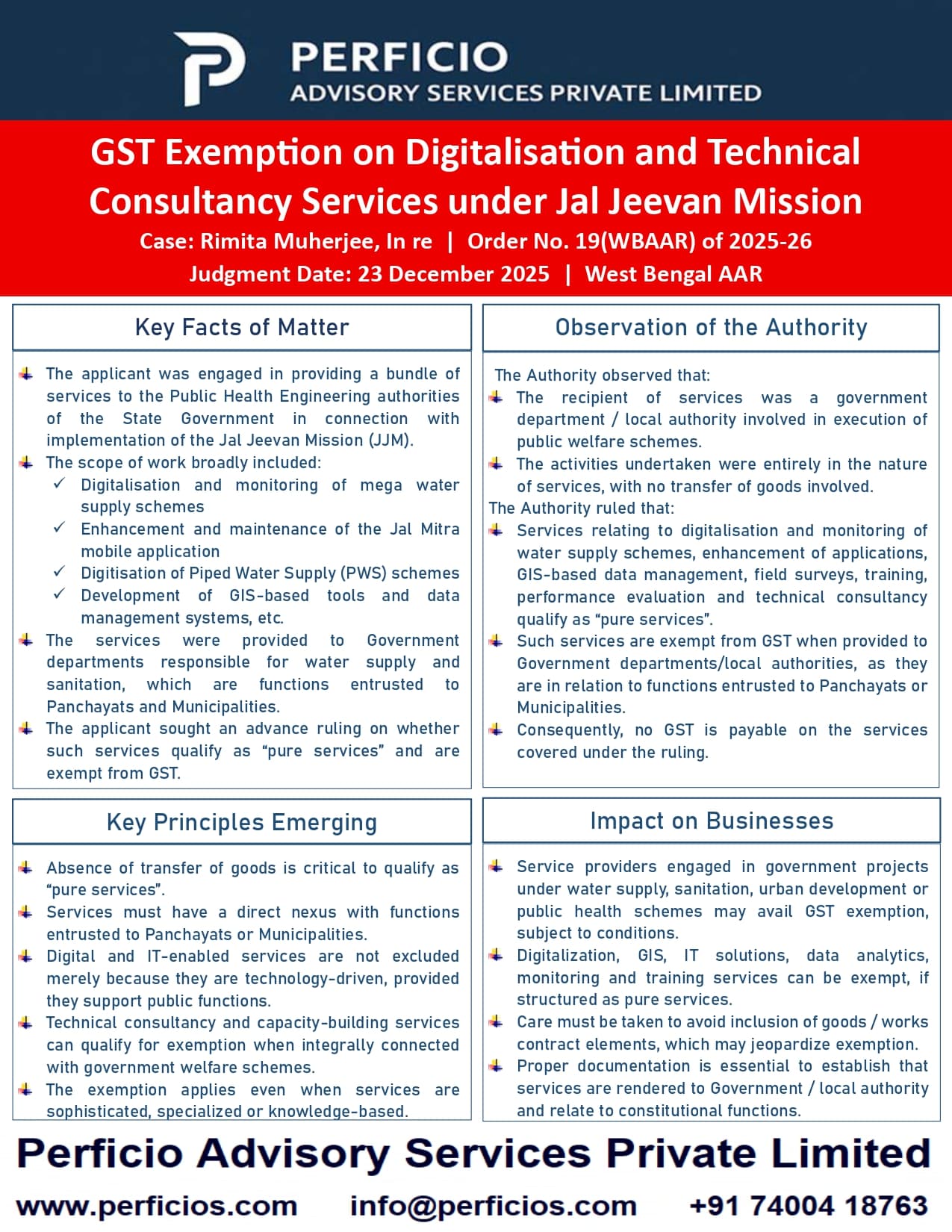

GST Advance Authority Ruling -- Exemption on Digitalisation and Technical Consultancy Services under Jal Jeevan Mission

PERFICIO

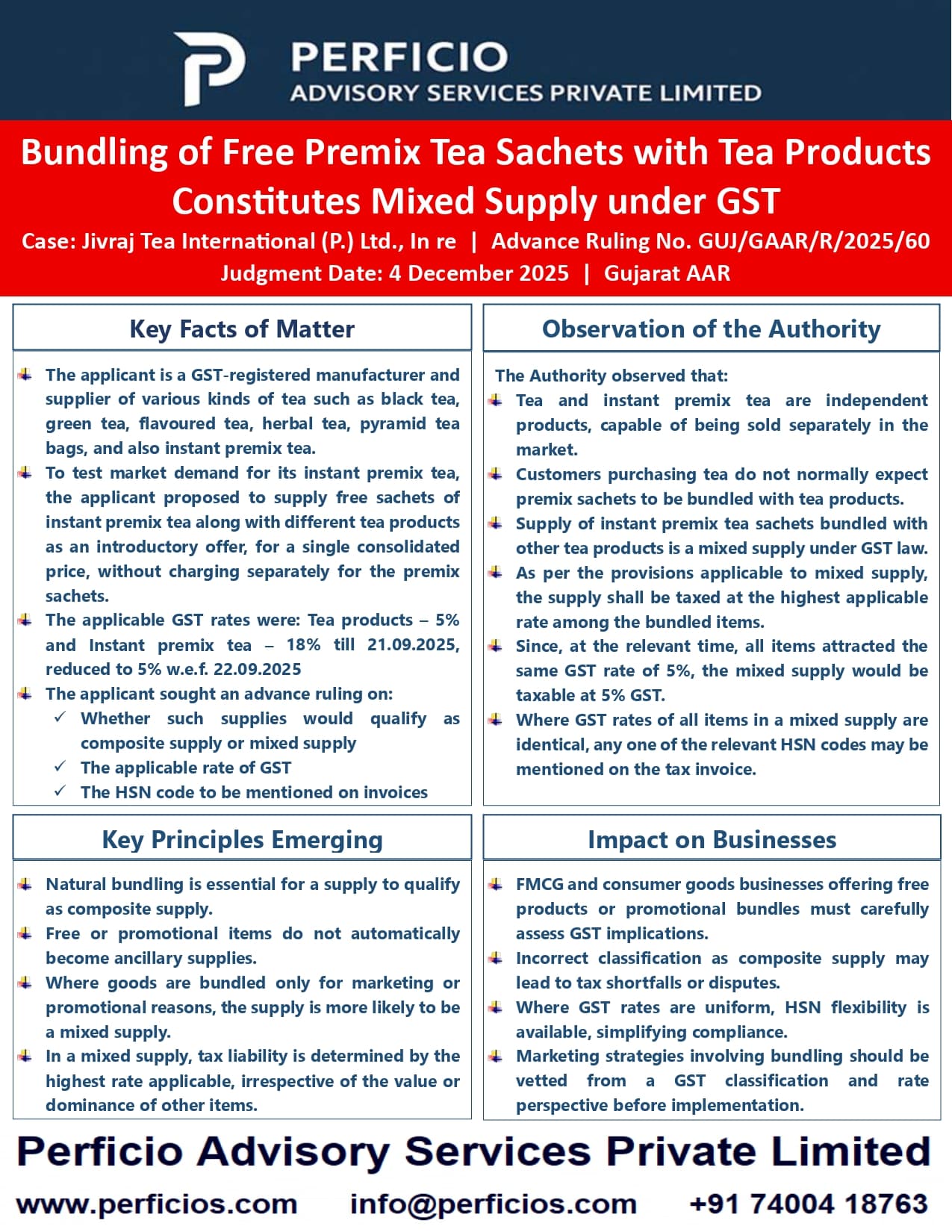

GST Advance Authority Ruling -- Bundling of Free Premix Tea Sachets with Tea Products Constitutes Mixed Supply under GST

PERFICIO

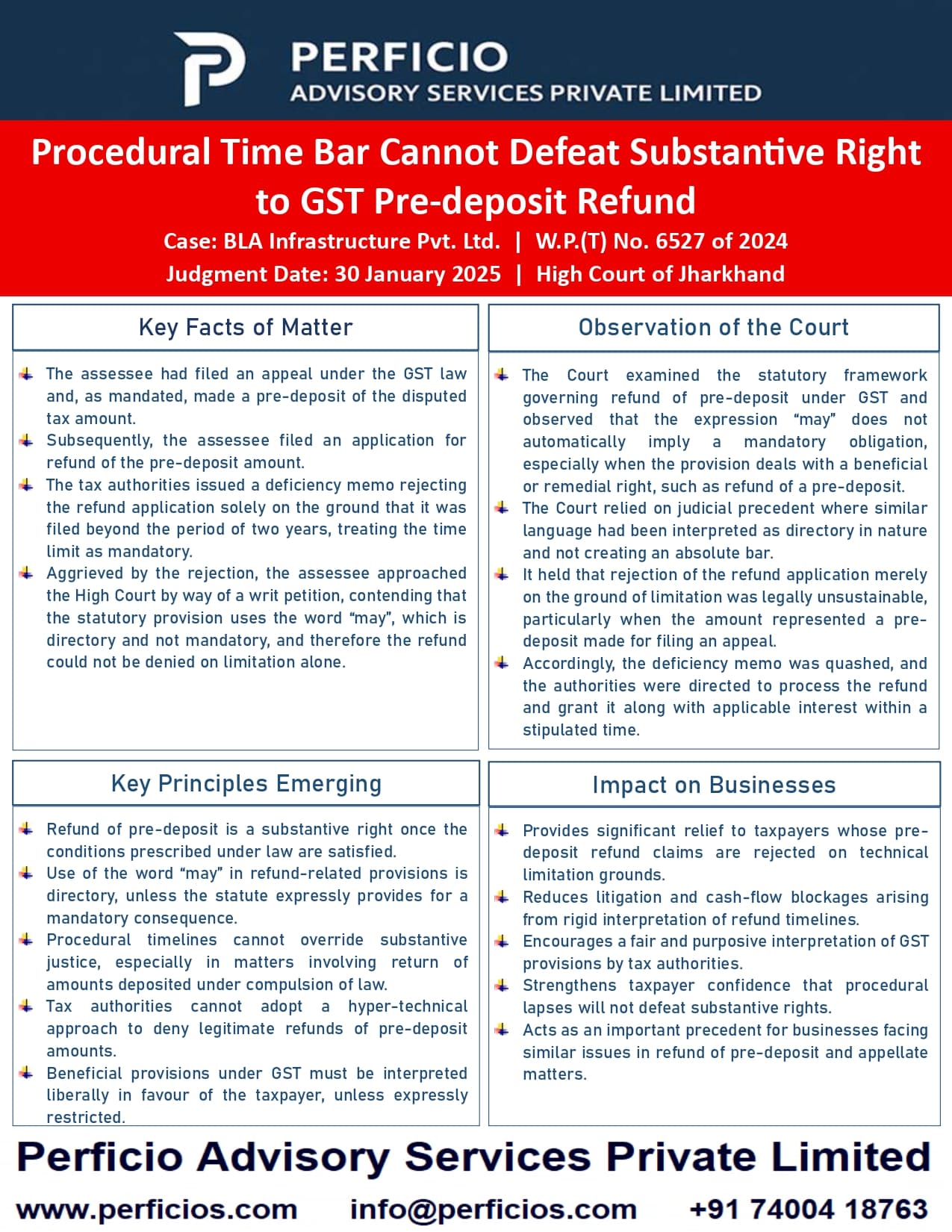

GST Ruling -- Procedural Time-bar cannot defeat Substantive Right to GST Pre-deposit Refund

PERFICIO

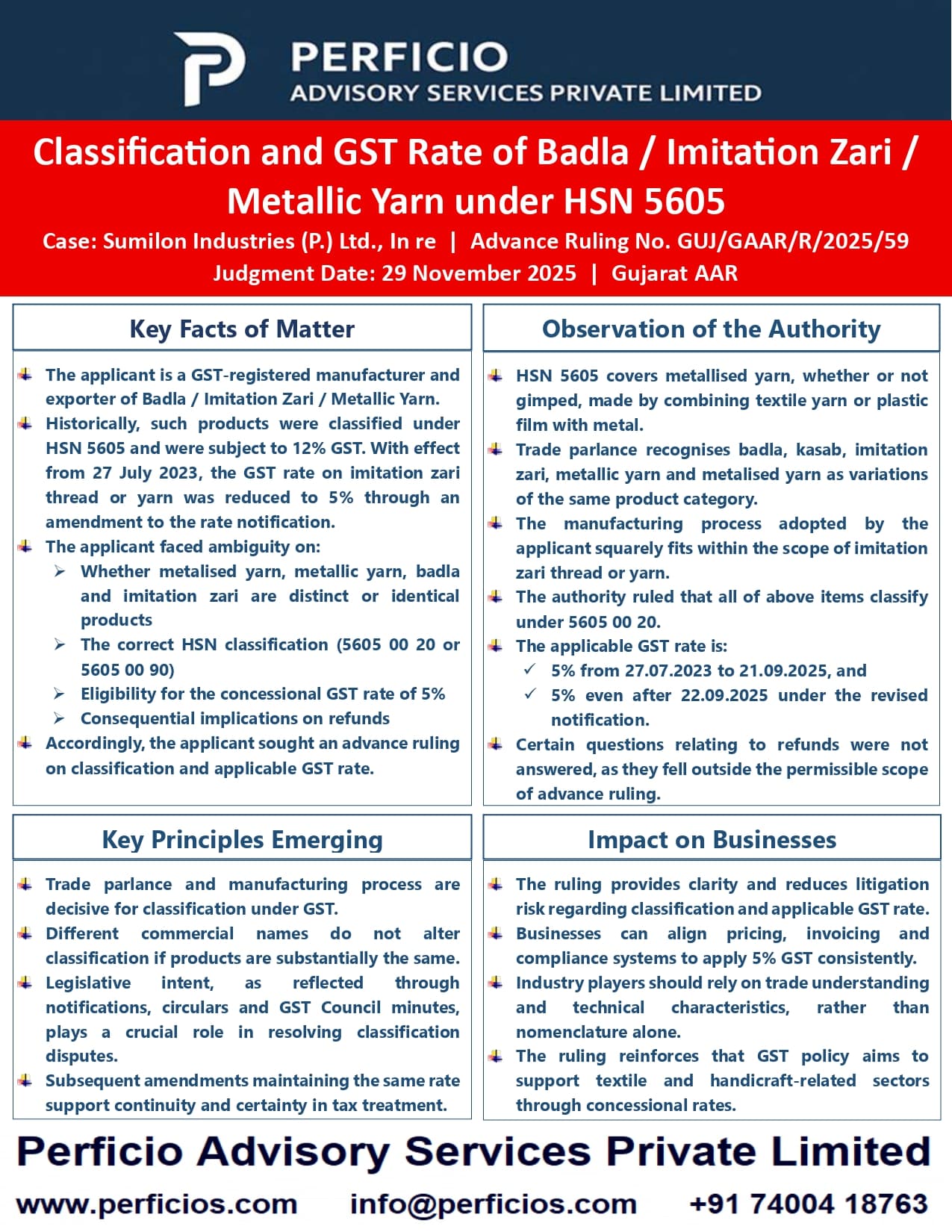

GST Advance Authority Ruling -- Classification and GST Rate of Badla / Imitation Zari / Metallic Yarn under HSN 5605

PERFICIO

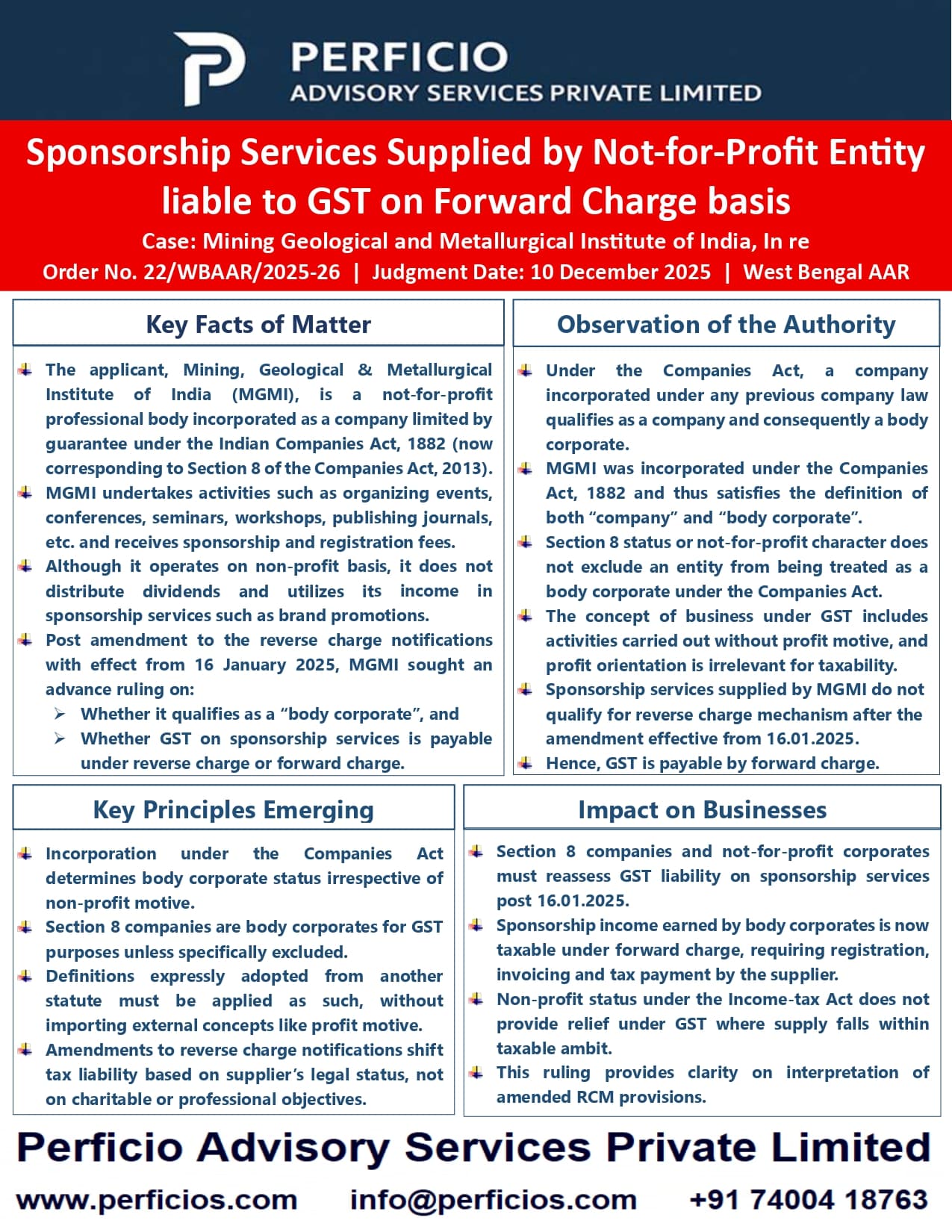

GST Advance Authority Ruling -- Sponsorship Services supplied by Not-for-Profit Entity liable to GST on Forward Charge basis

PERFICIO

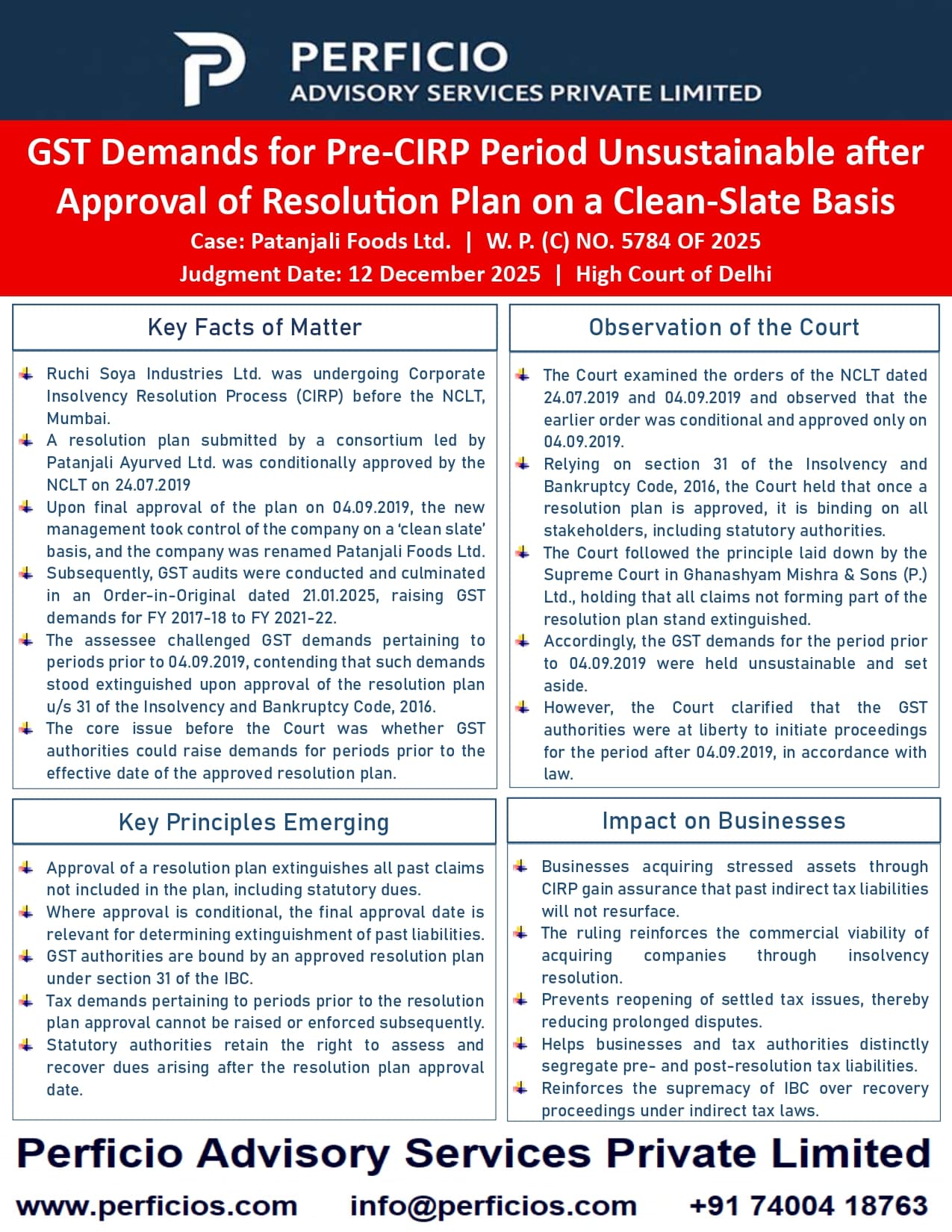

GST High Court Ruling -- Demand for Pre-CIRP period unsustainable after Approval of Resolution plan on a "Clean-Slate Basis"

PERFICIO

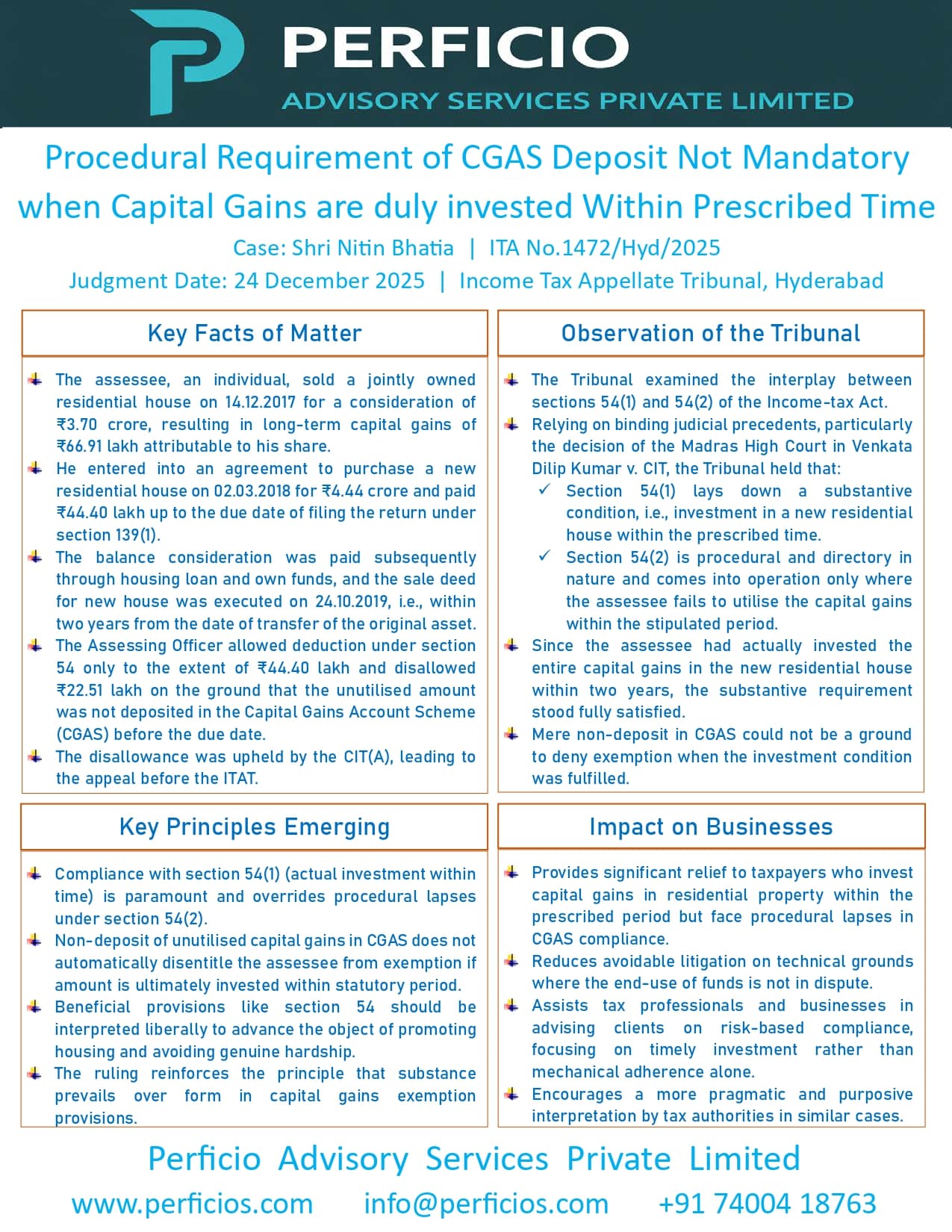

Income Tax Ruling -- Procedural Requirement of CGAS Deposit not Mandatory when Capital Gains are duly invested within prescribed time

PERFICIO

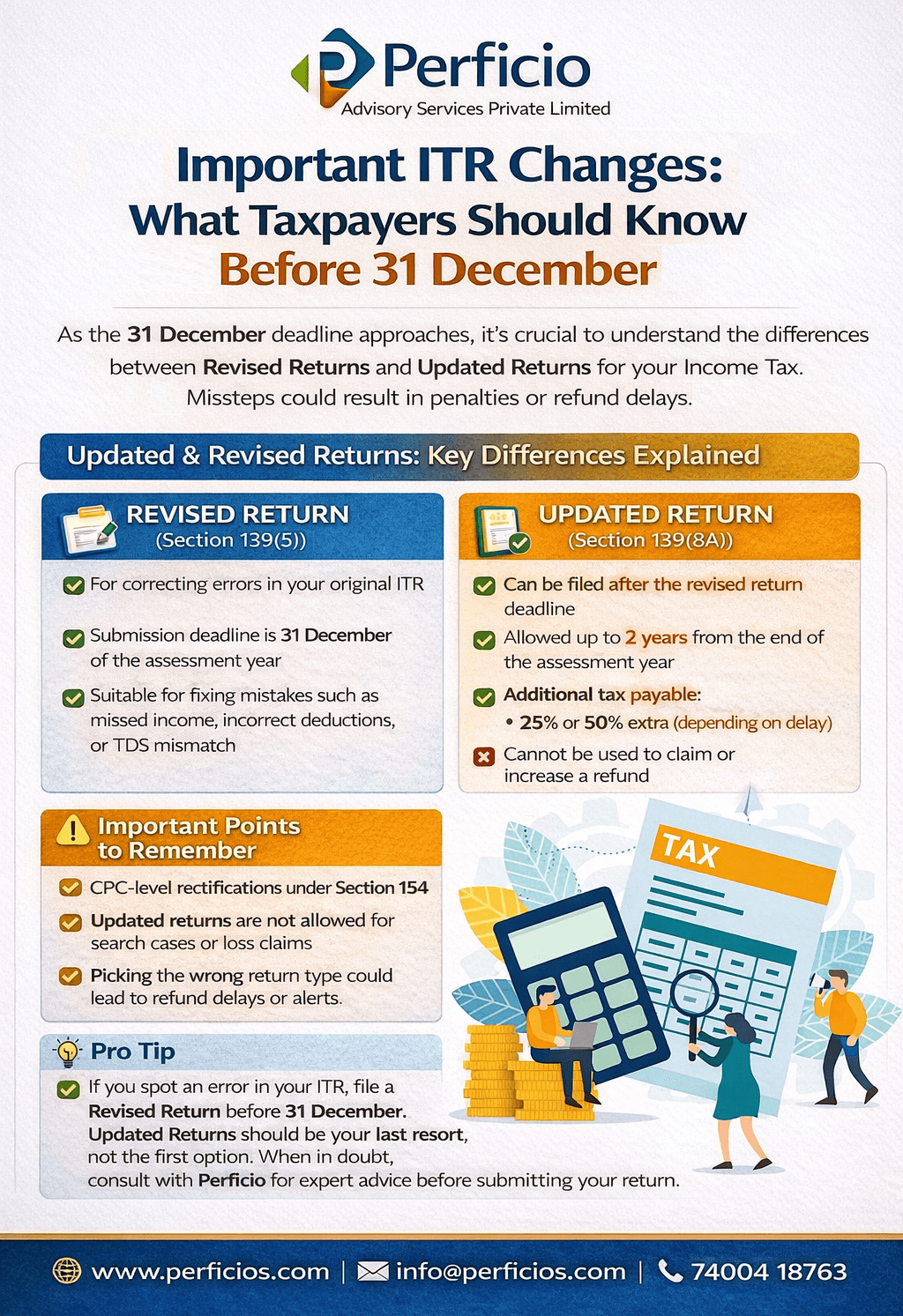

Important ITR Changes Taxpayers should know before 31st December !!!

PERFICIO

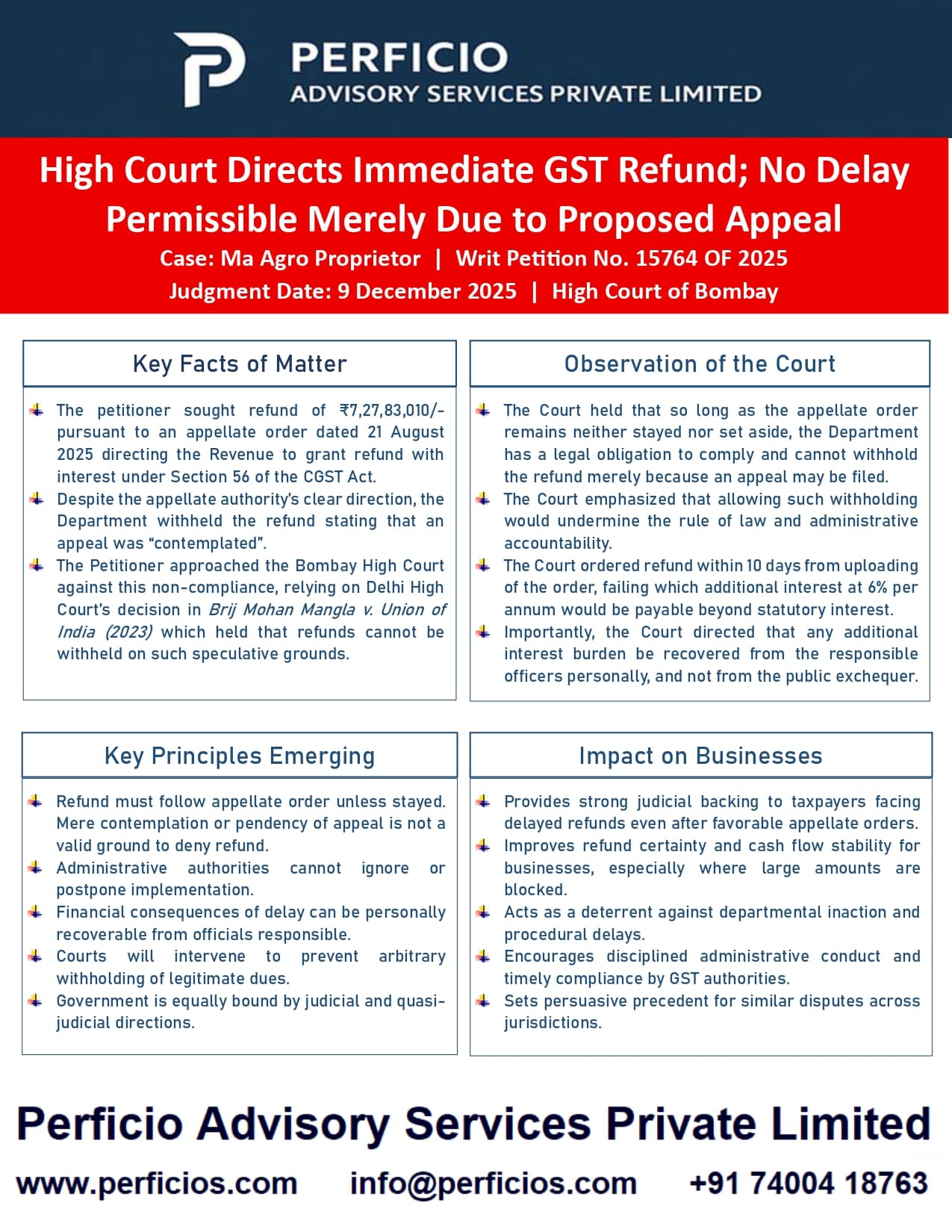

GST Ruling -- High Court directs immediate GST Refund; No Delay Permissible merely due to Proposed Appeal

PERFICIO

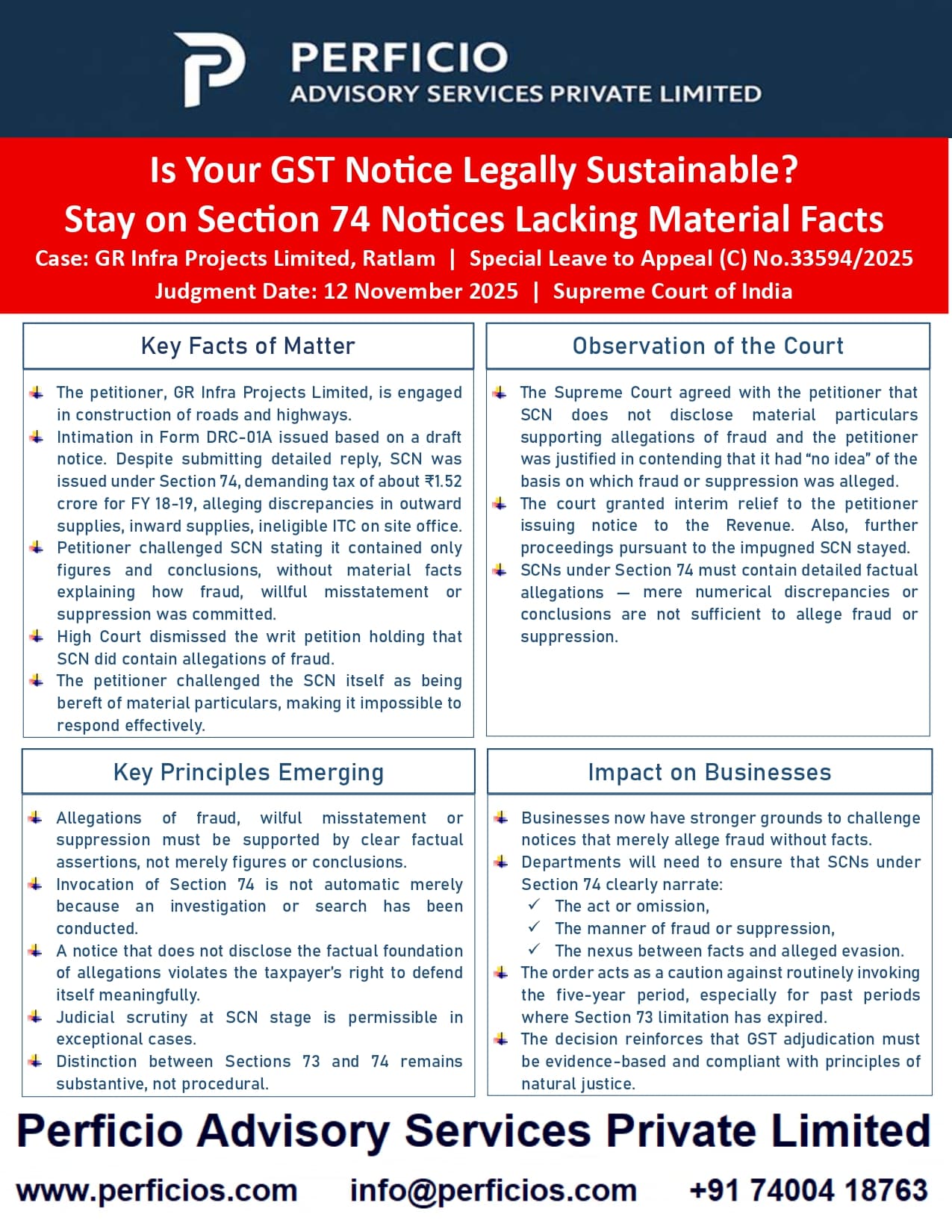

GST Ruling -- Is your notice legally sustainable? Supreme Court puts stay on Section 74 notices lacking material facts

PERFICIO

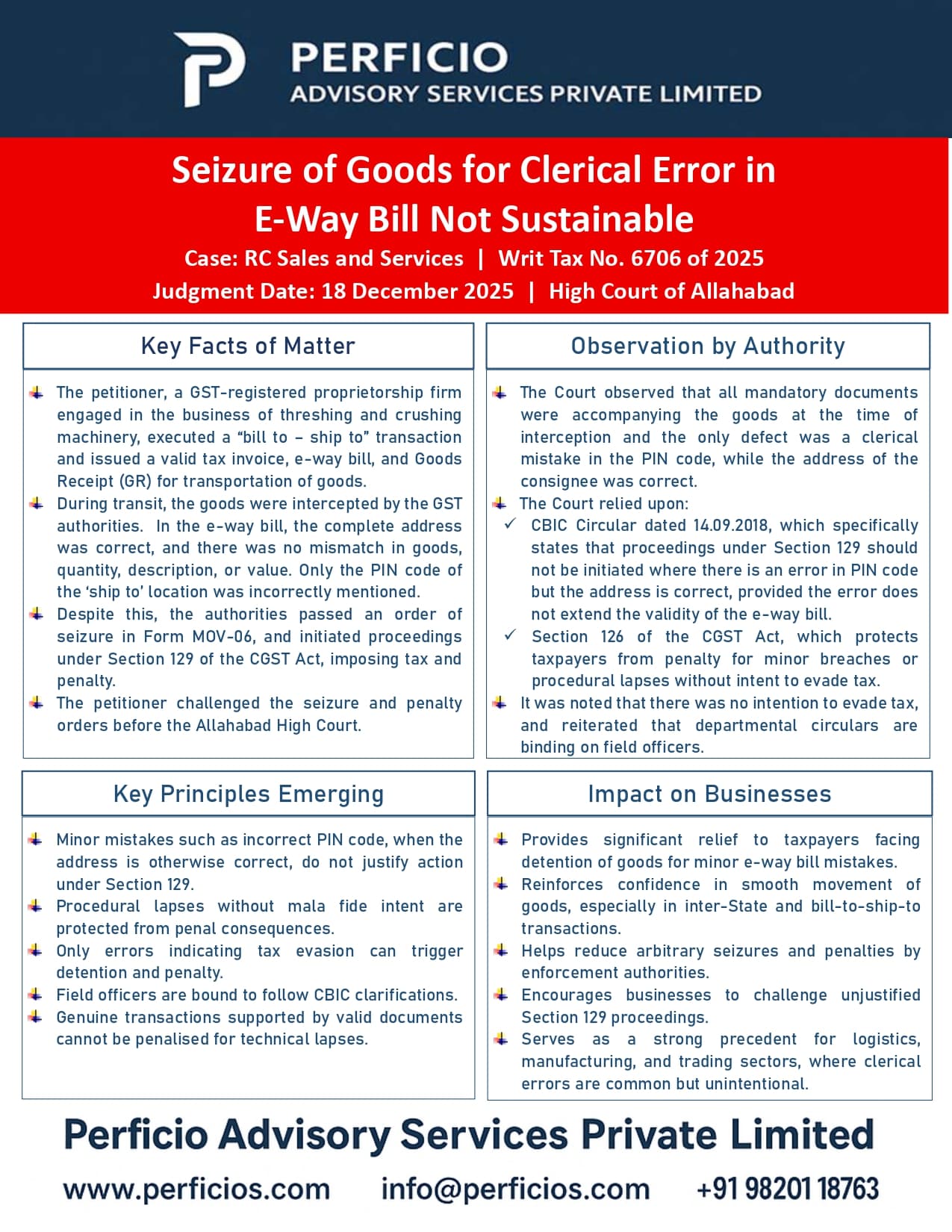

GST High Court Ruling -- Seizure of Goods for Clerical Error in E-Way Bill Not Sustainable

PERFICIO

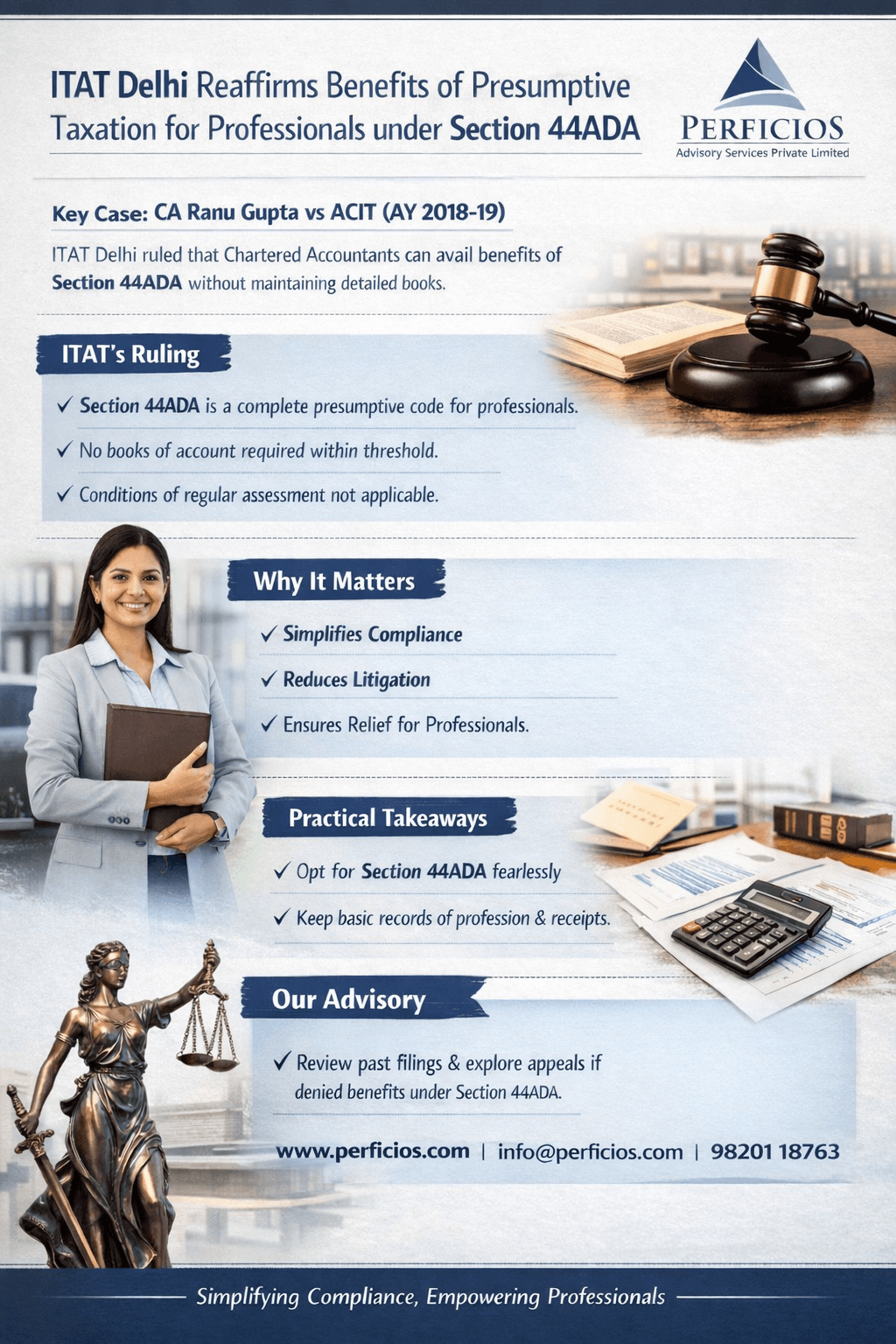

ITAT Delhi Reaffirms Benefits of Presumptive Taxation for Professionals under Section 44ADA

PERFICIO

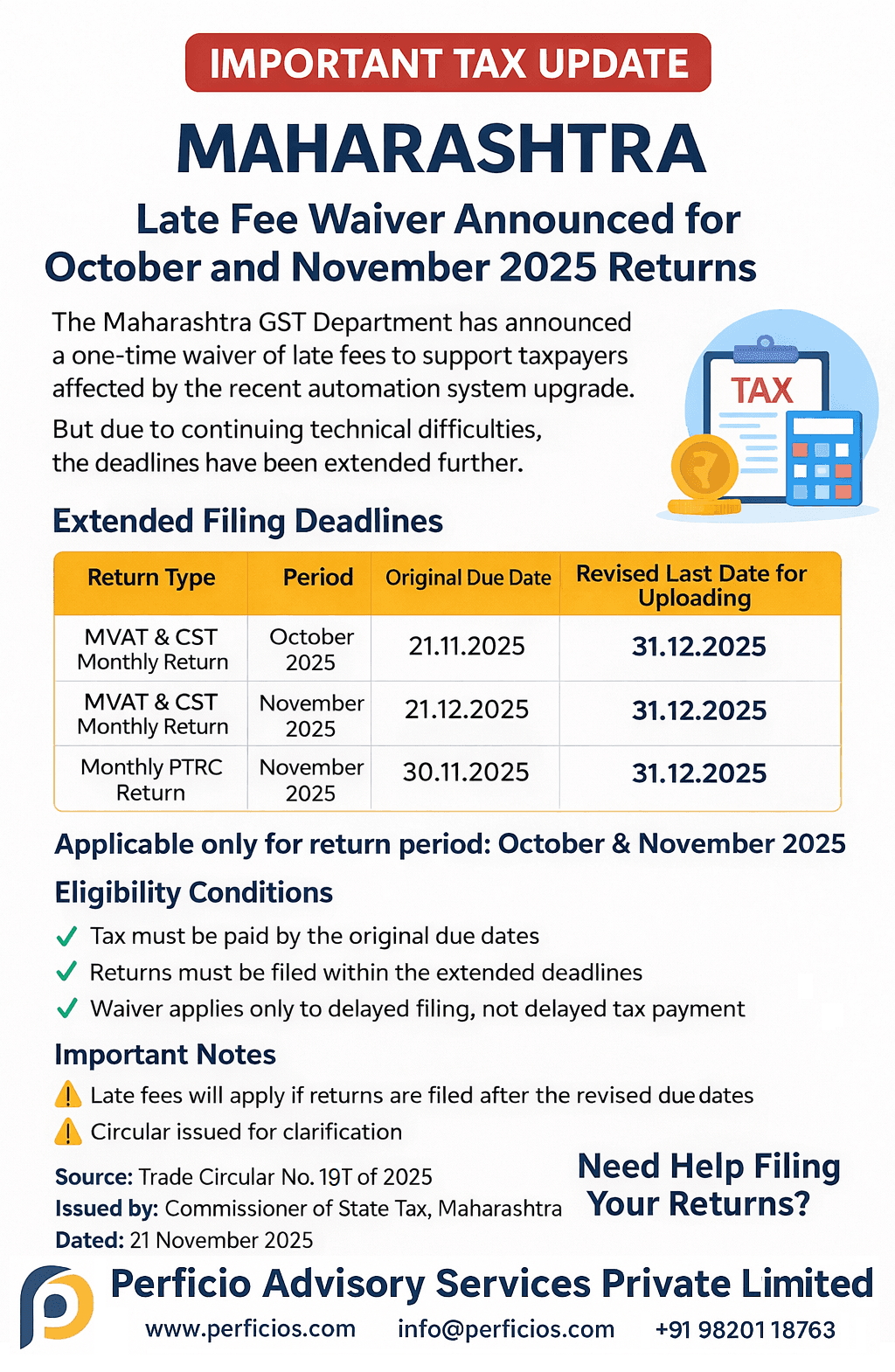

Maharashtra GST Update -- Late Fee Waiver Announced for October and November 2025 Returns

PERFICIO

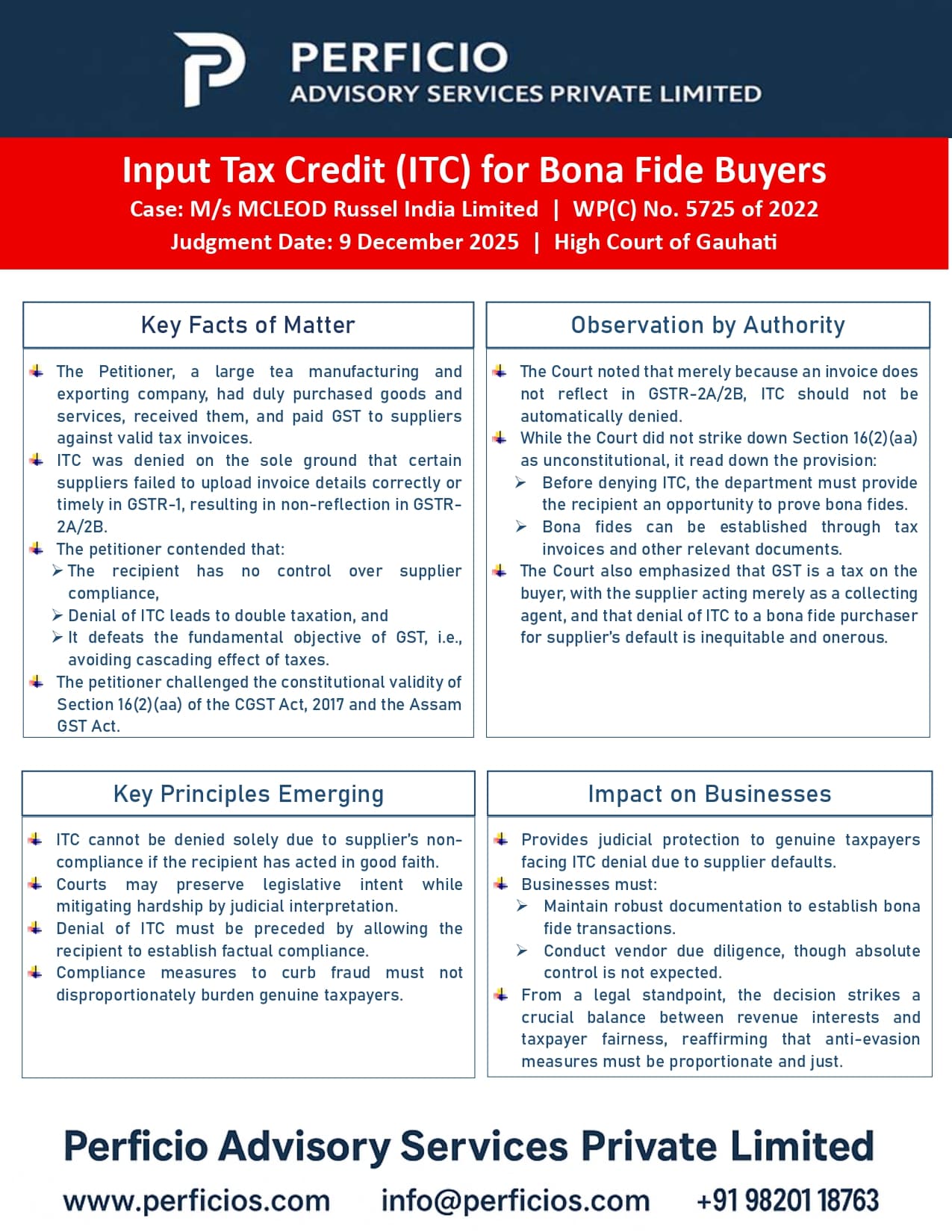

GST High Court Ruling -- Safeguarding Input Tax Credit (ITC) for Bona fide Buyers

PERFICIO

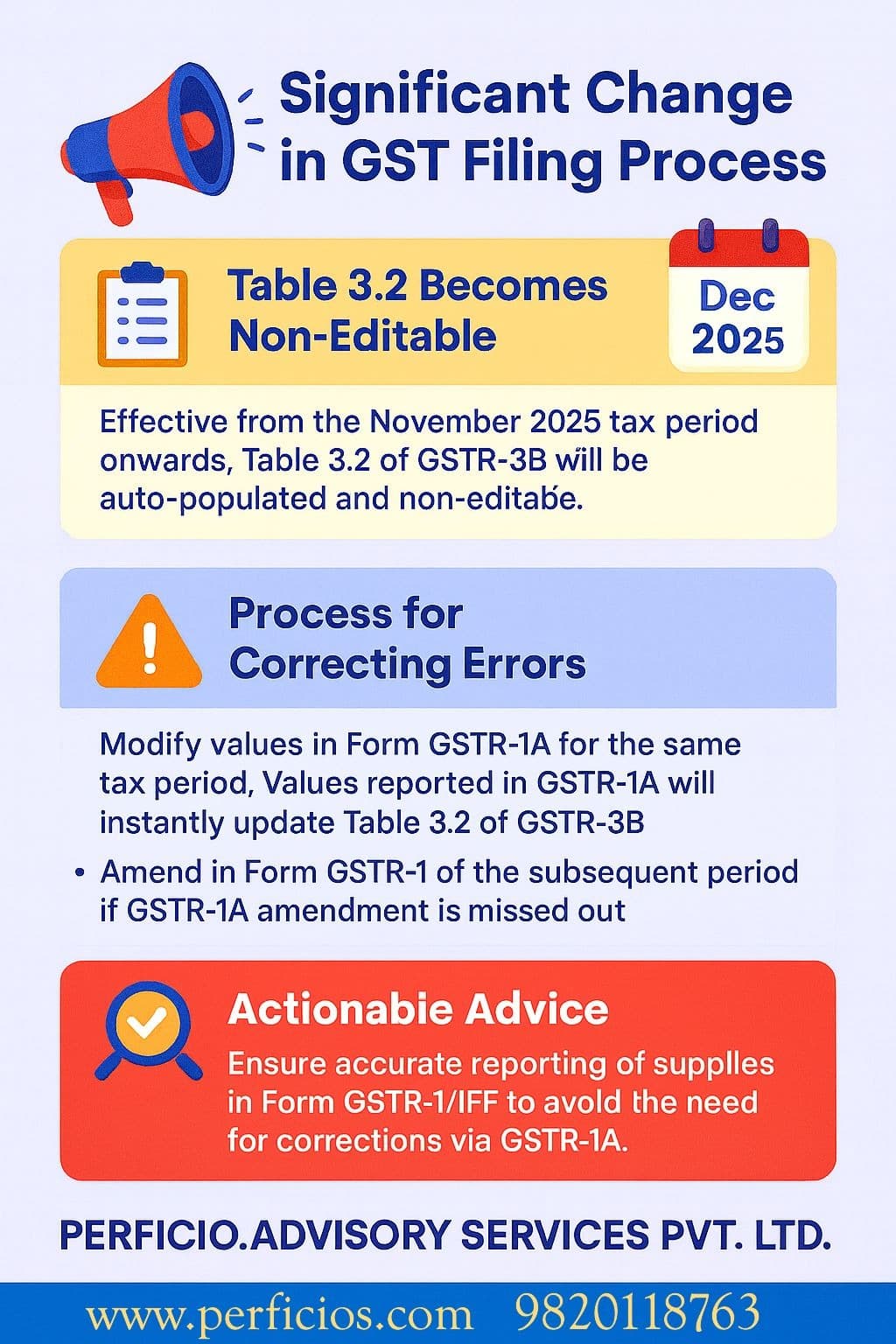

GST Update - Significant Change in GST Filing Process

PERFICIO

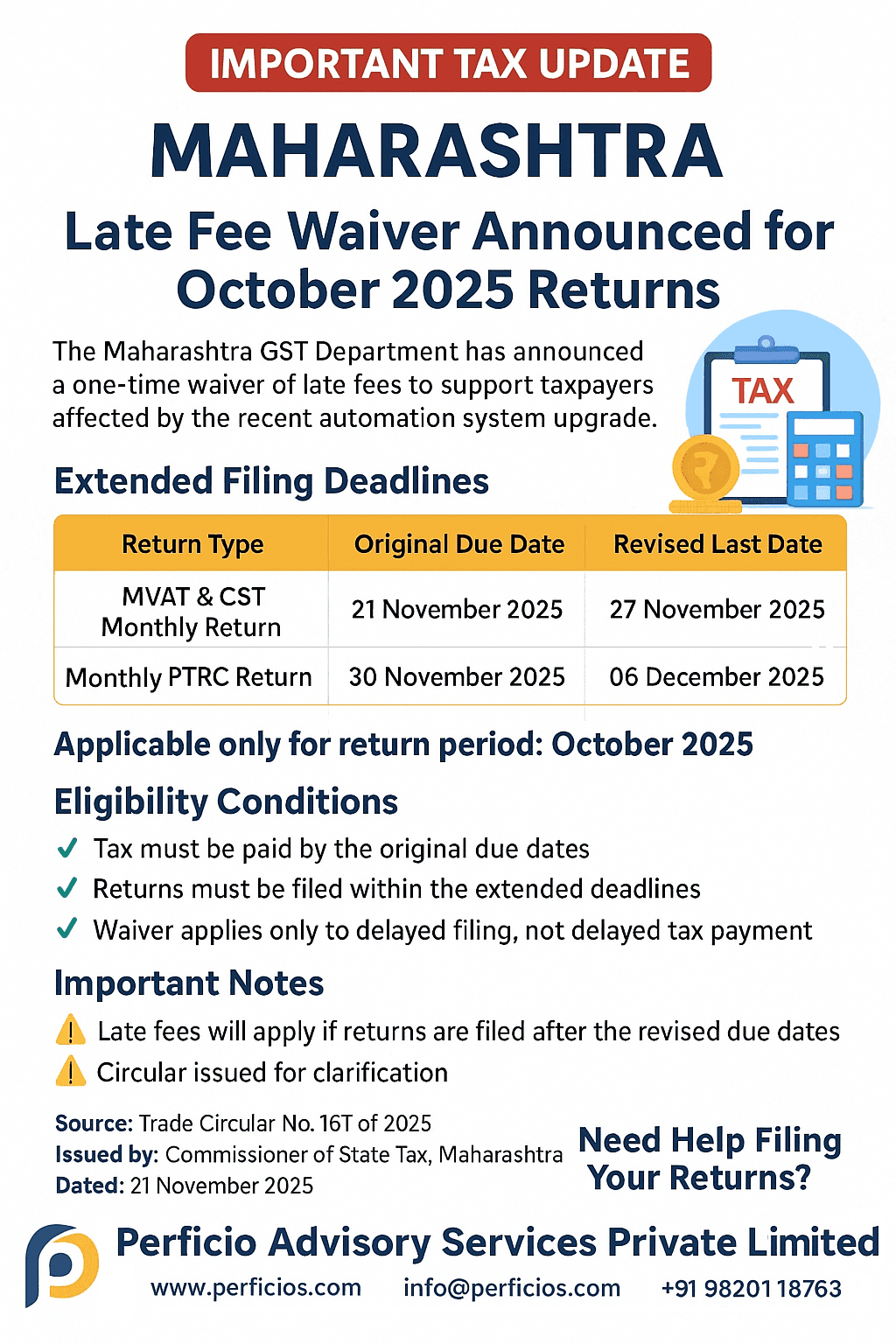

Important Tax Update !!! Maharashtra GST department announces Late fee waiver for MVAT, CST and PTRC returns for the month of October 2025...

PERFICIO

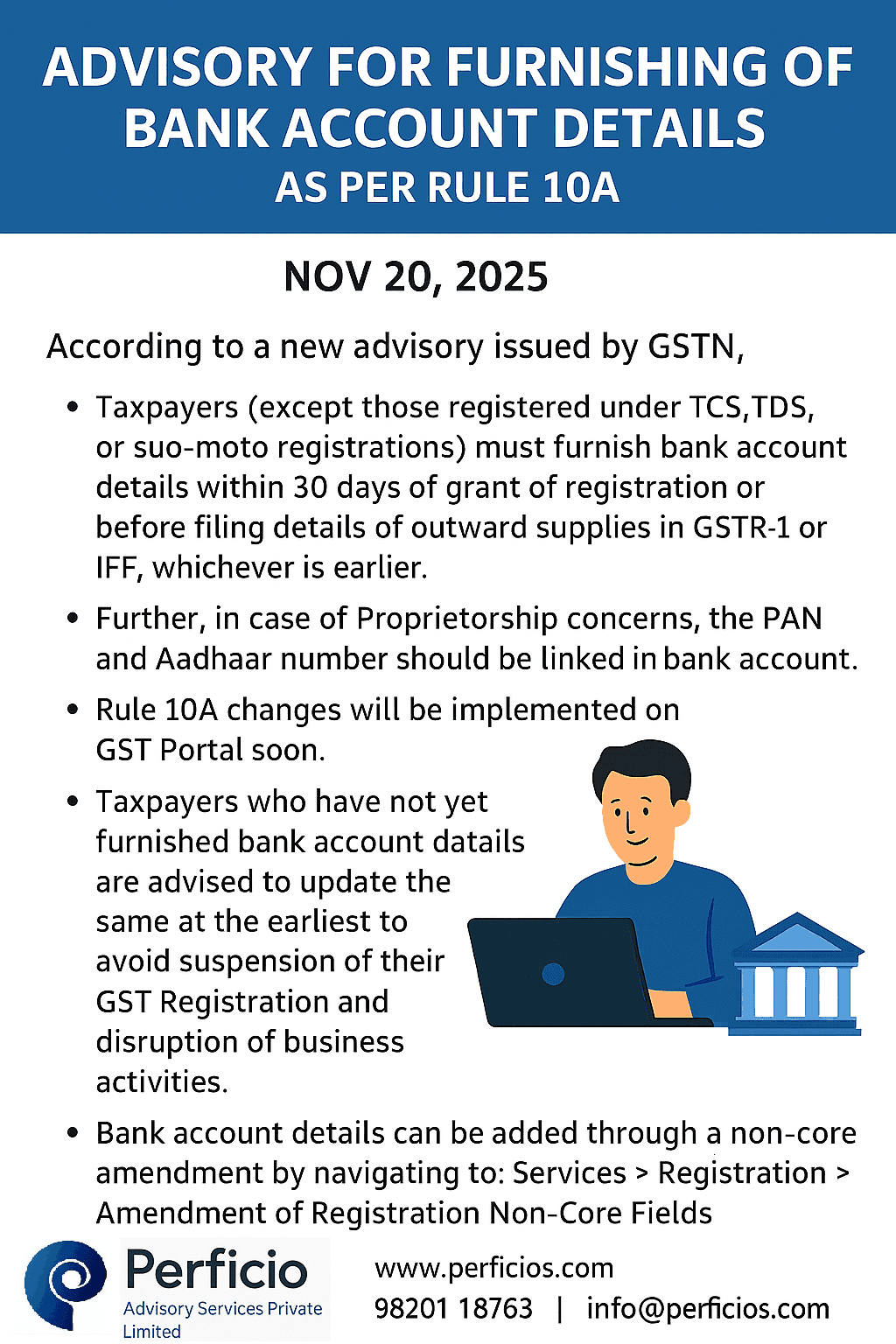

GSTN Advisory - Furnishing of Bank account details as per Rule 10(A)

PERFICIO

GST High Court Ruling - SCN served on Old Email held Invalid; Court declares GST Notice Time-barred

PERFICIO

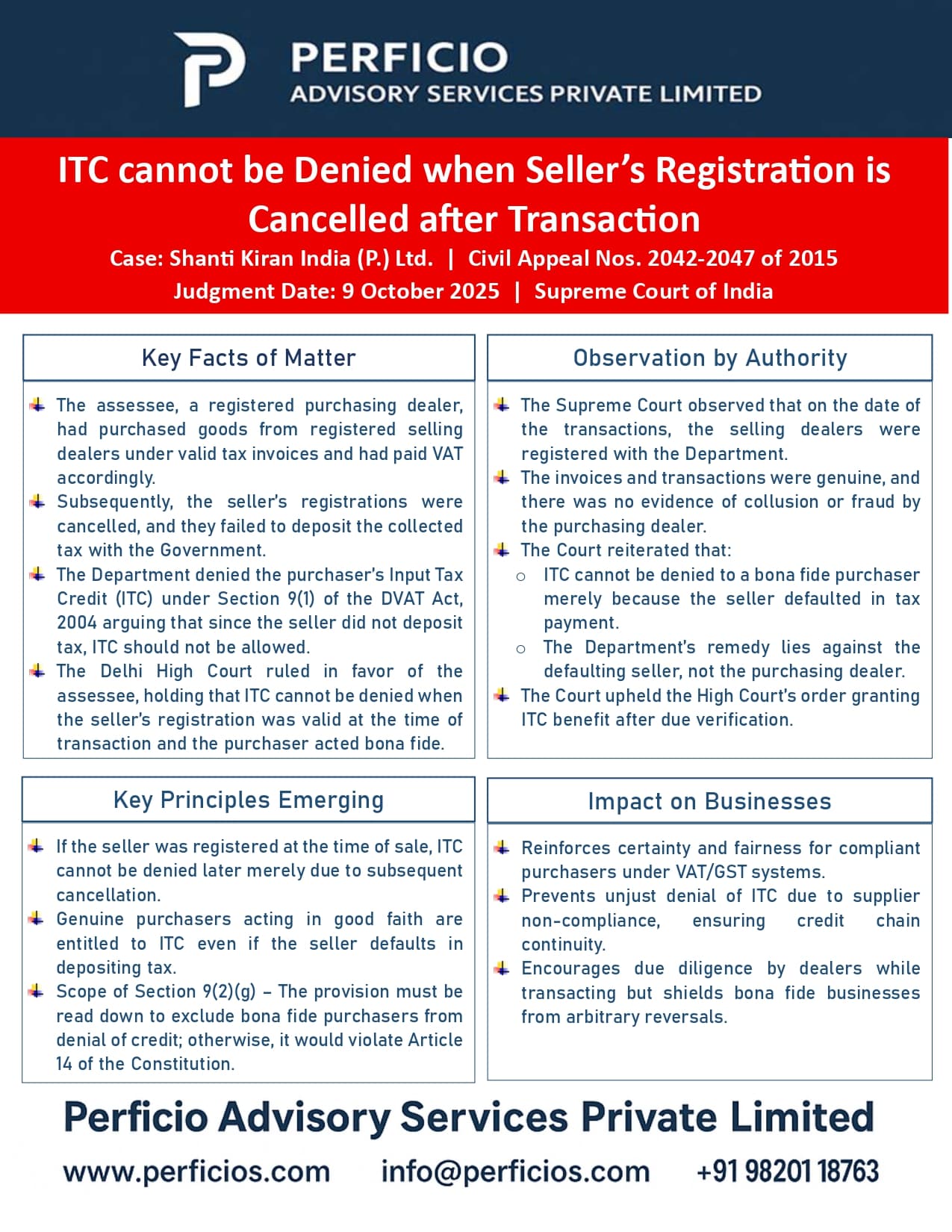

GST Supreme Court Ruling - ITC cannot be Denied if Seller's Registration is Cancelled after Transaction

PERFICIO

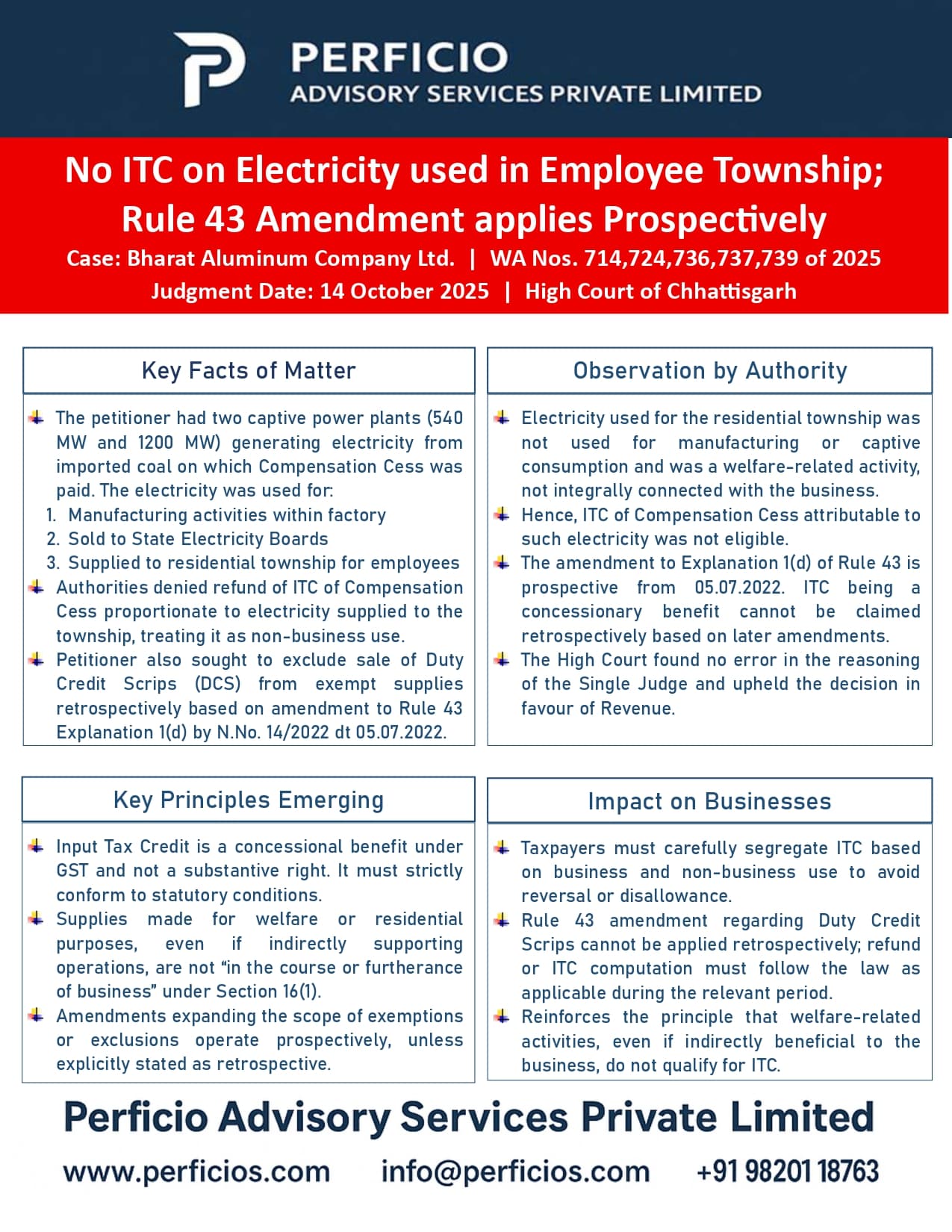

GST High Court Ruling - No ITC on Electricity used in Employee Township; Rule 43 Amendment applies Prospectively

PERFICIO

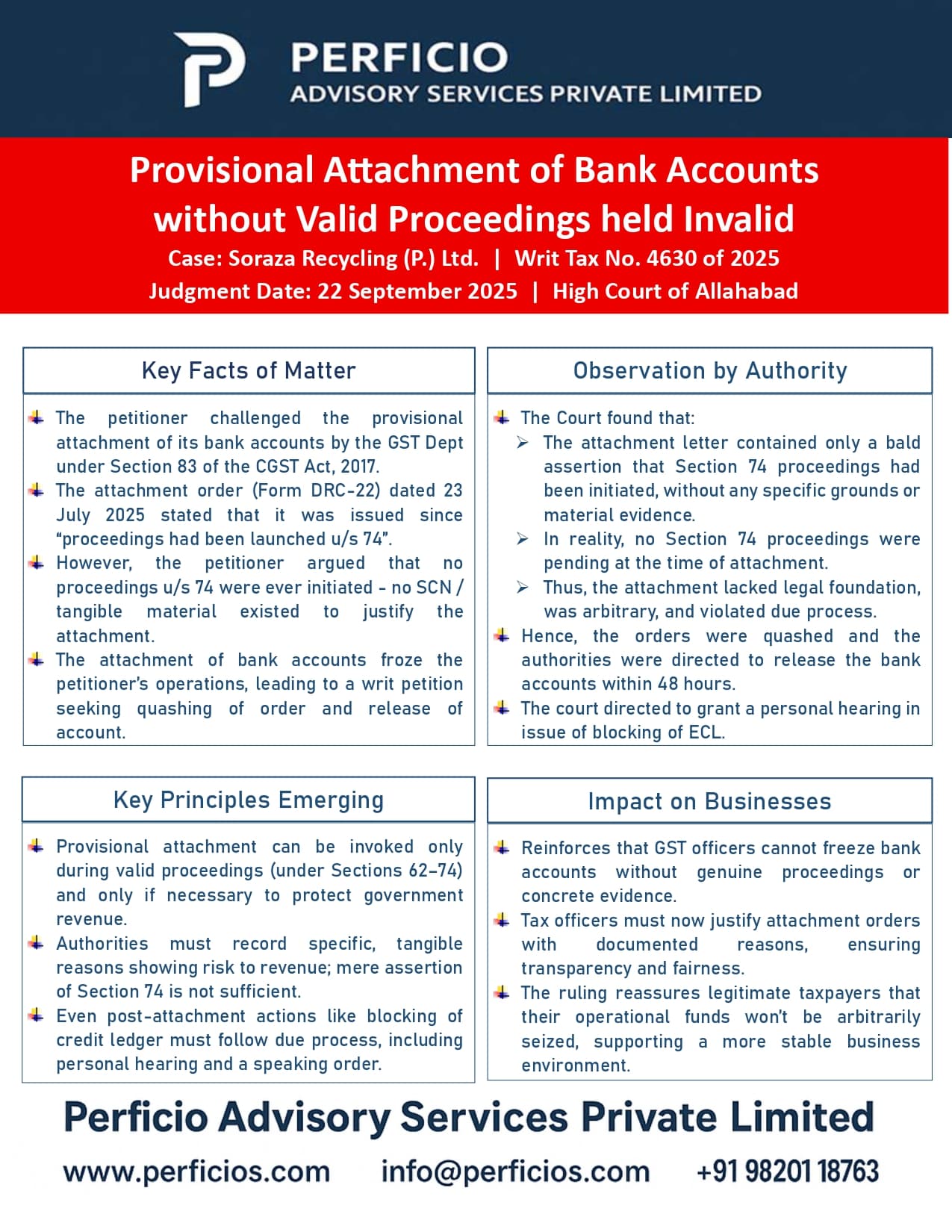

GST High Court Ruling - Provisional Attachment of Bank Accounts without Valid Proceedings held Invalid

PERFICIO

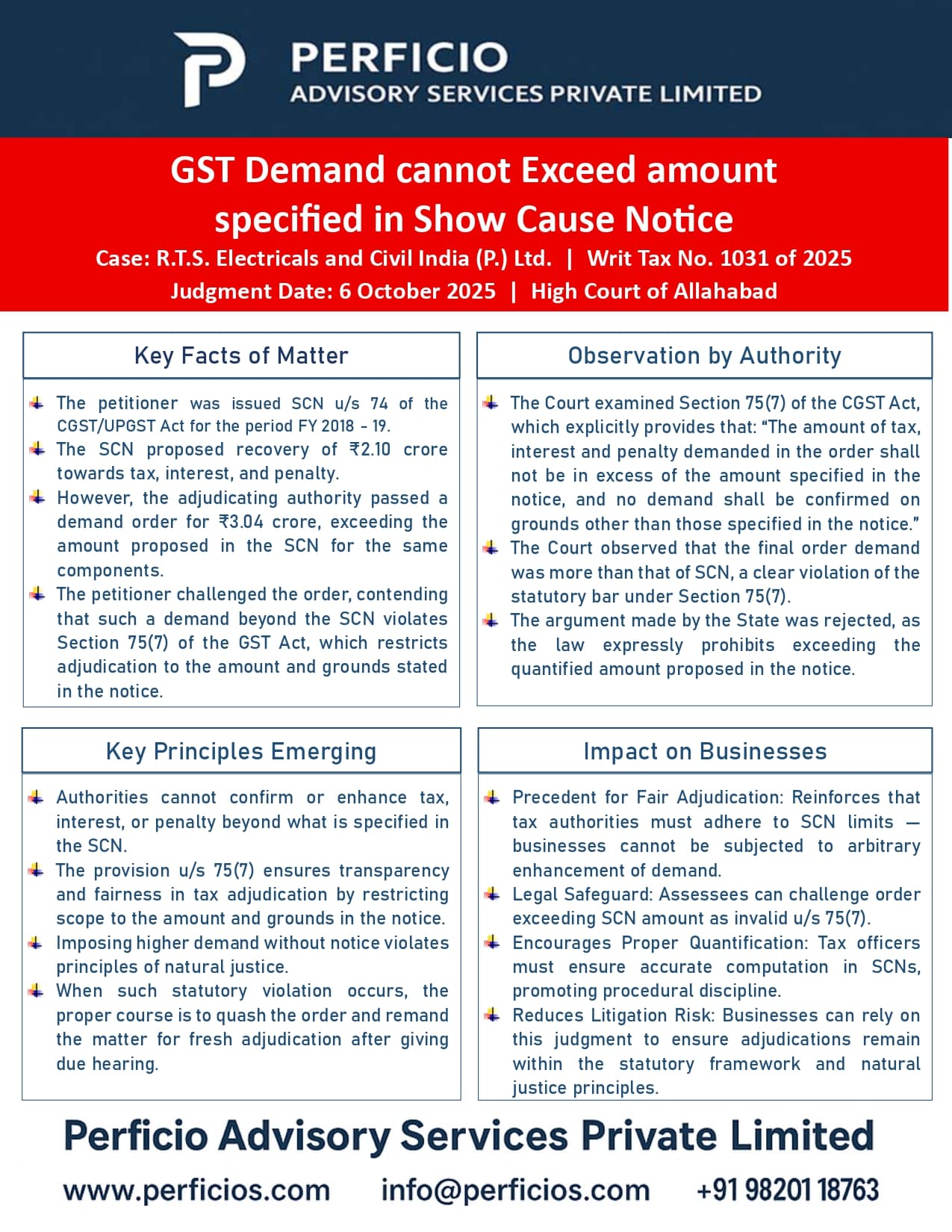

GST High Court Ruling - Demand cannot Exceed amount specified in Show Cause Notice (SCN)

PERFICIO

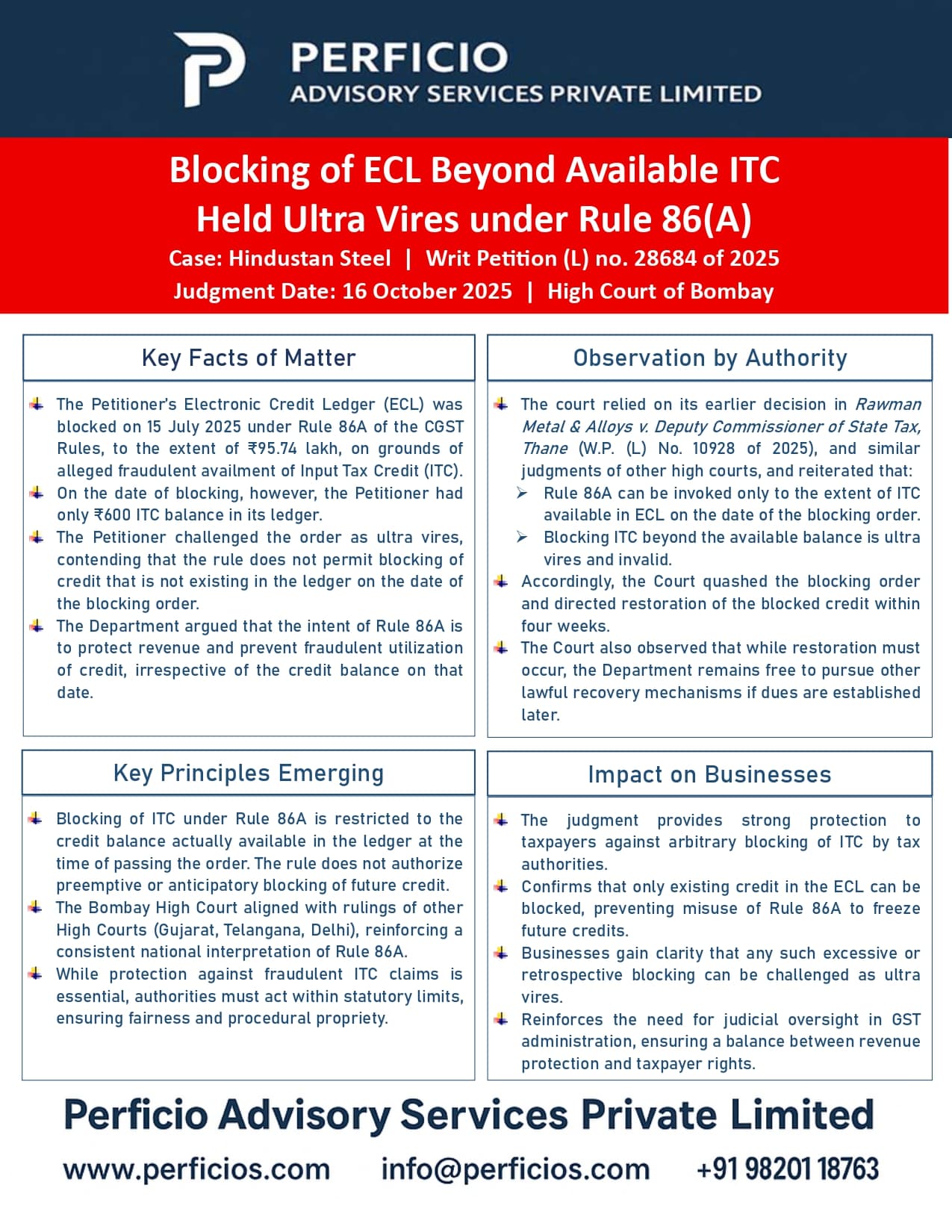

GST High Court Ruling - Blocking of Electronic Credit Ledger (ECL) beyond available ITC Held Ultra Vires under Rule 86(A)

PERFICIO

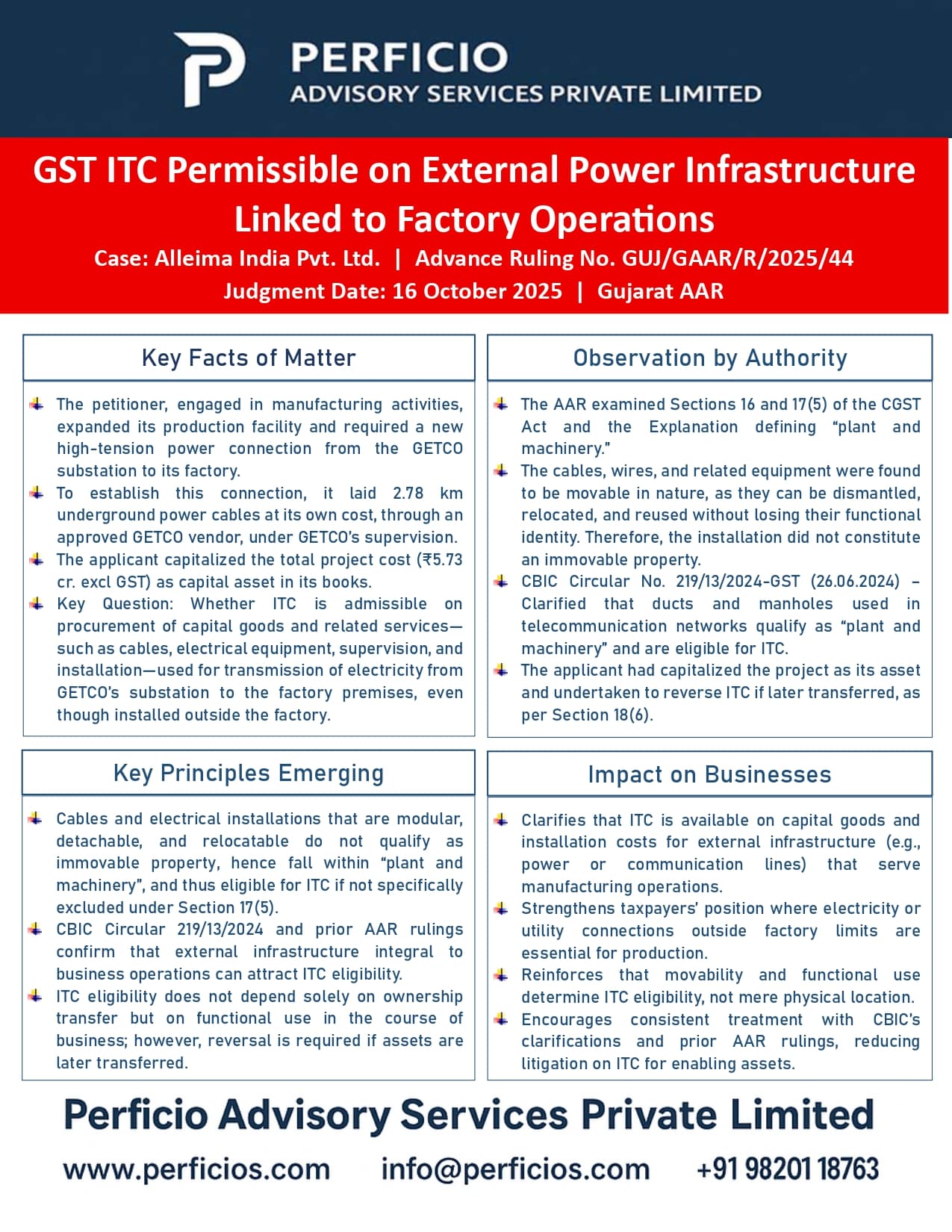

GST AAR Ruling - ITC Permissible on External Power Infrastructure Linked to Factory Operations

PERFICIO

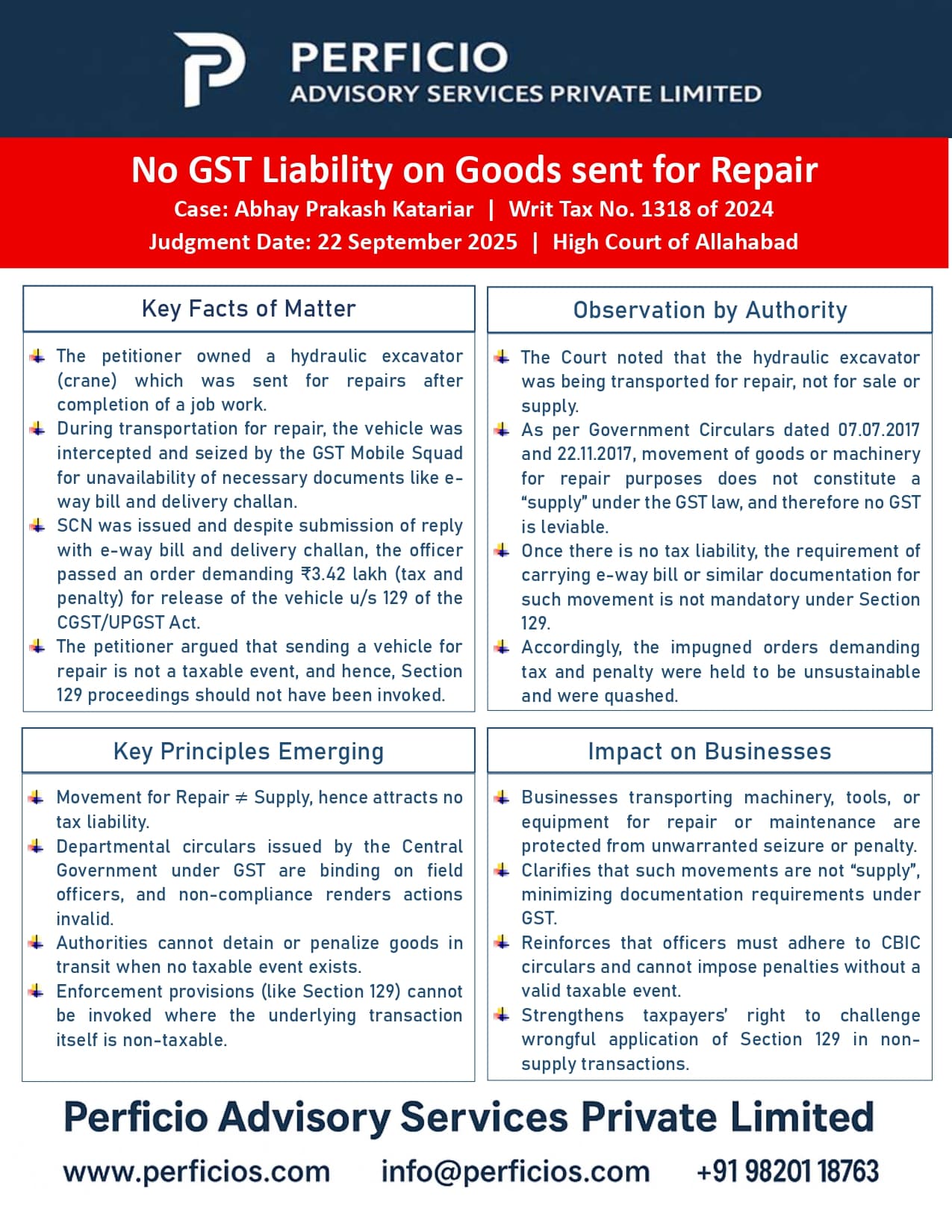

GST High Court Ruling - No GST Liability on Goods sent for Repair

PERFICIO

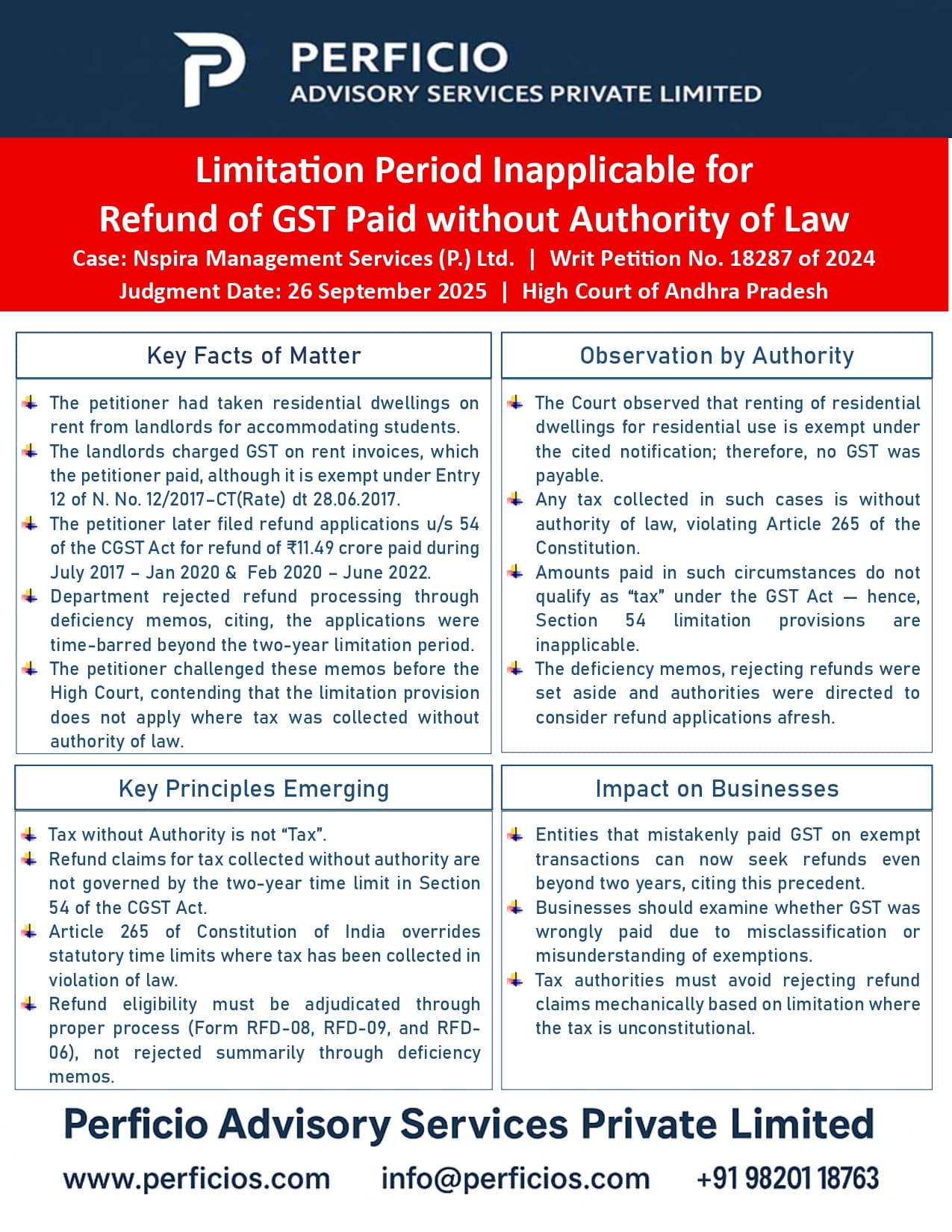

GST High Court Ruling - Limitation Period inapplicable for Refund of GST paid without Authority of Law

PERFICIO

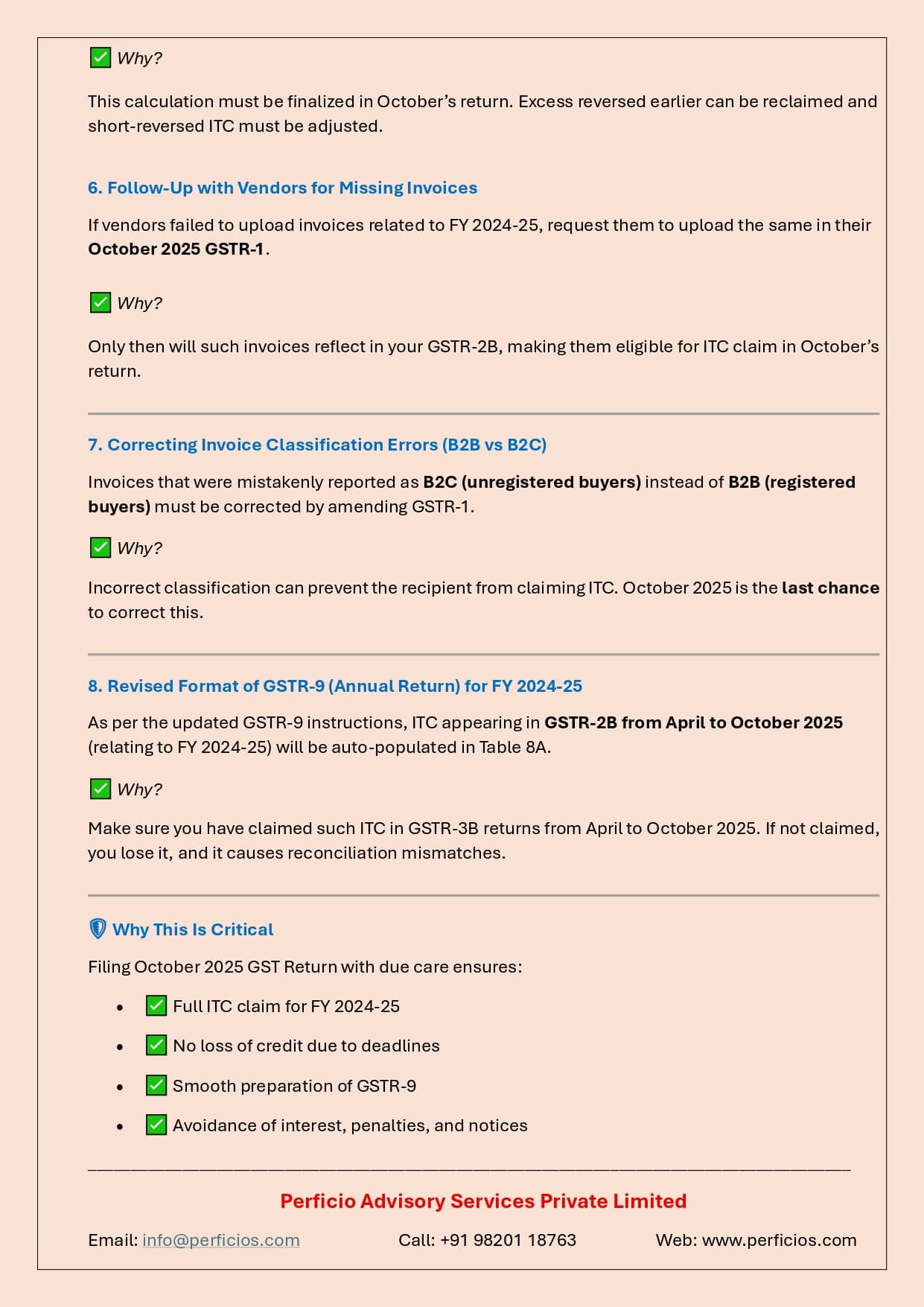

Important points to remember while filing GST Returns for October 2025

PERFICIO

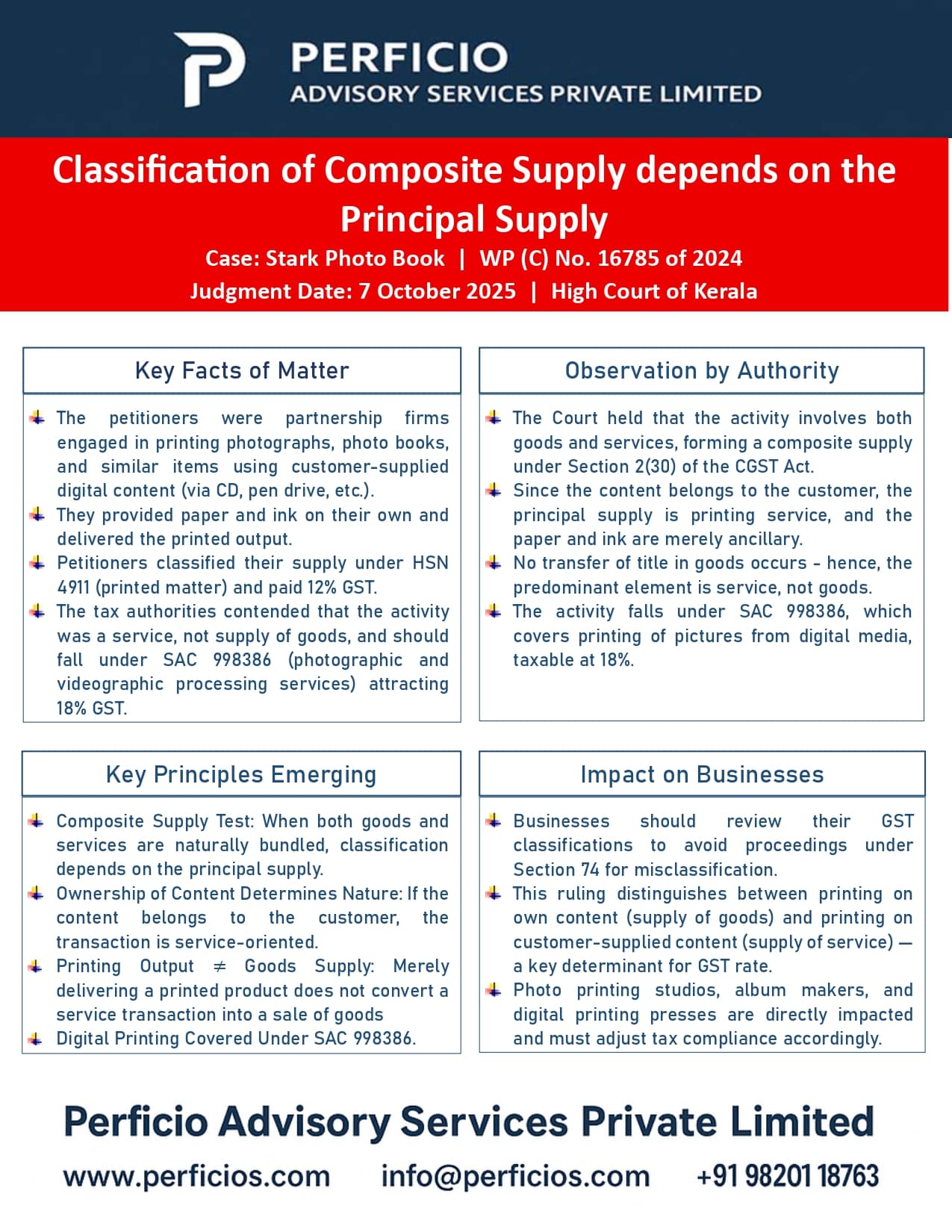

GST Case Law Judgment: Classification of Composite Supply depends on the Principal Supply

PERFICIO

GST AAR Ruling - Classification of Interactive Flat Panel Displays (IFPDs) under GST

PERFICIO

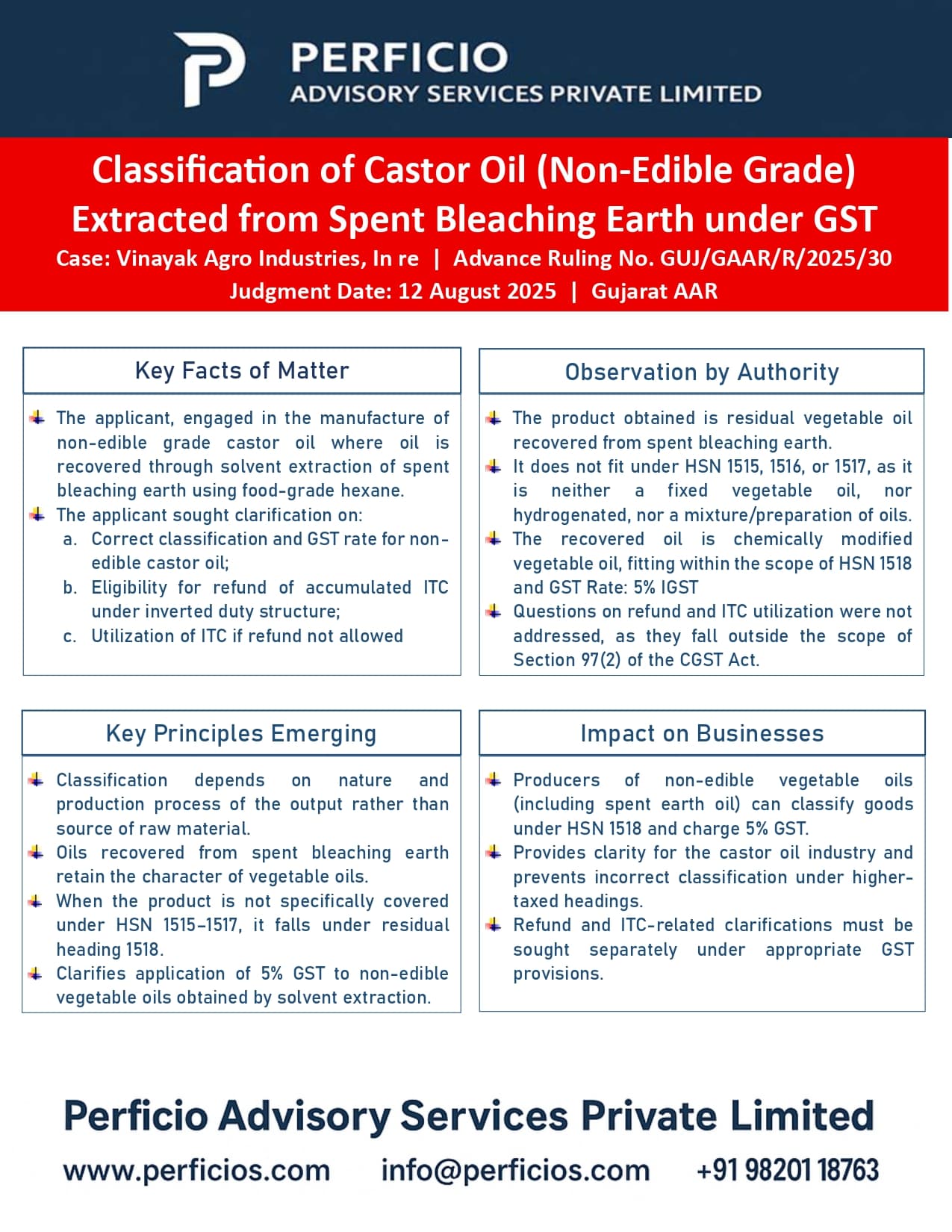

GST AAR Ruling - Classification of Castor Oil (Non-Edible Grade) extracted from Spent Bleaching Earth under GST

PERFICIO

GST AAR Ruling - Applicability of RCM on Purchase of M-Sand, P-Sand, Boulders, Blue Metals, Bricks and Hollow Bricks from Unregistered Persons

PERFICIO

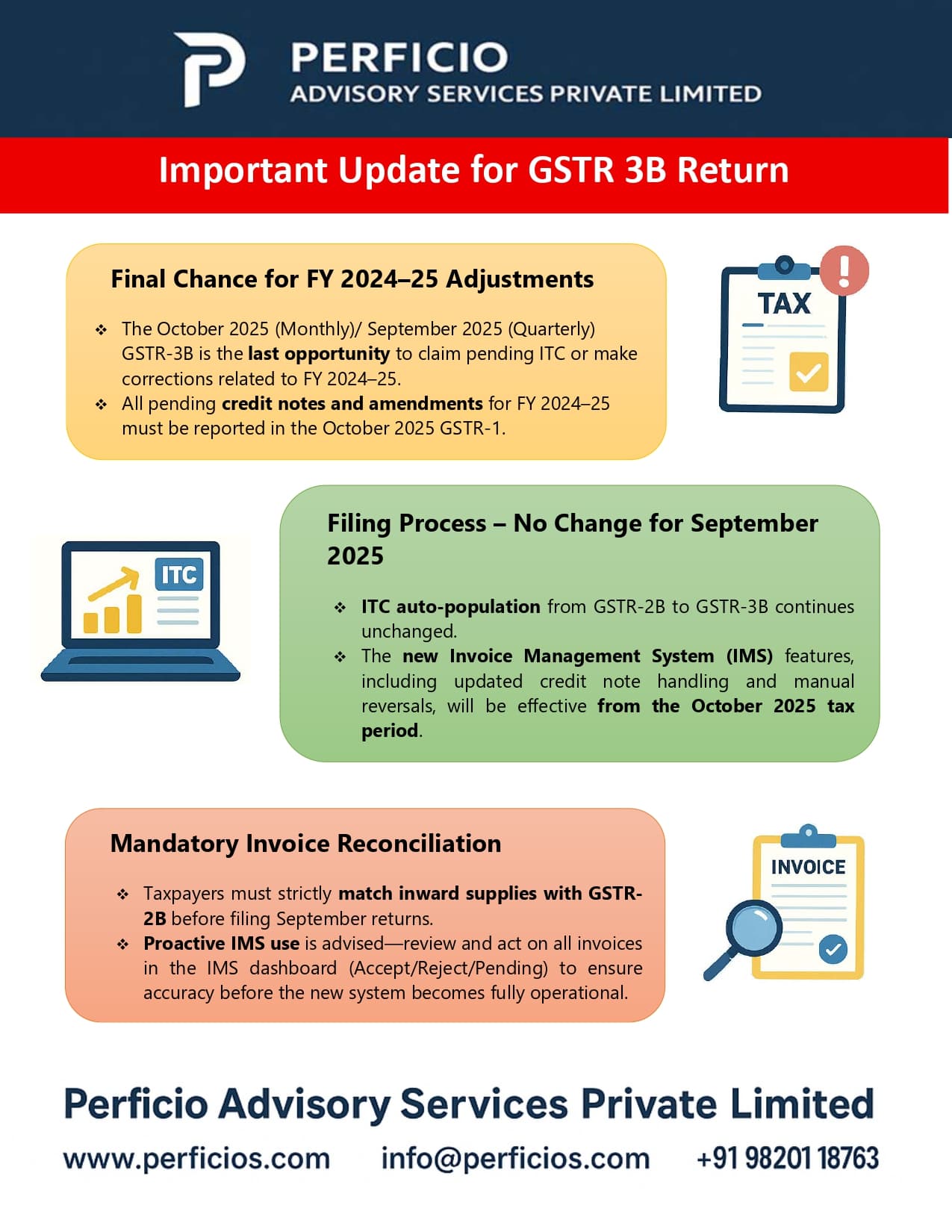

GST Alert!! Important update for GSTR 3B Return...

PERFICIO

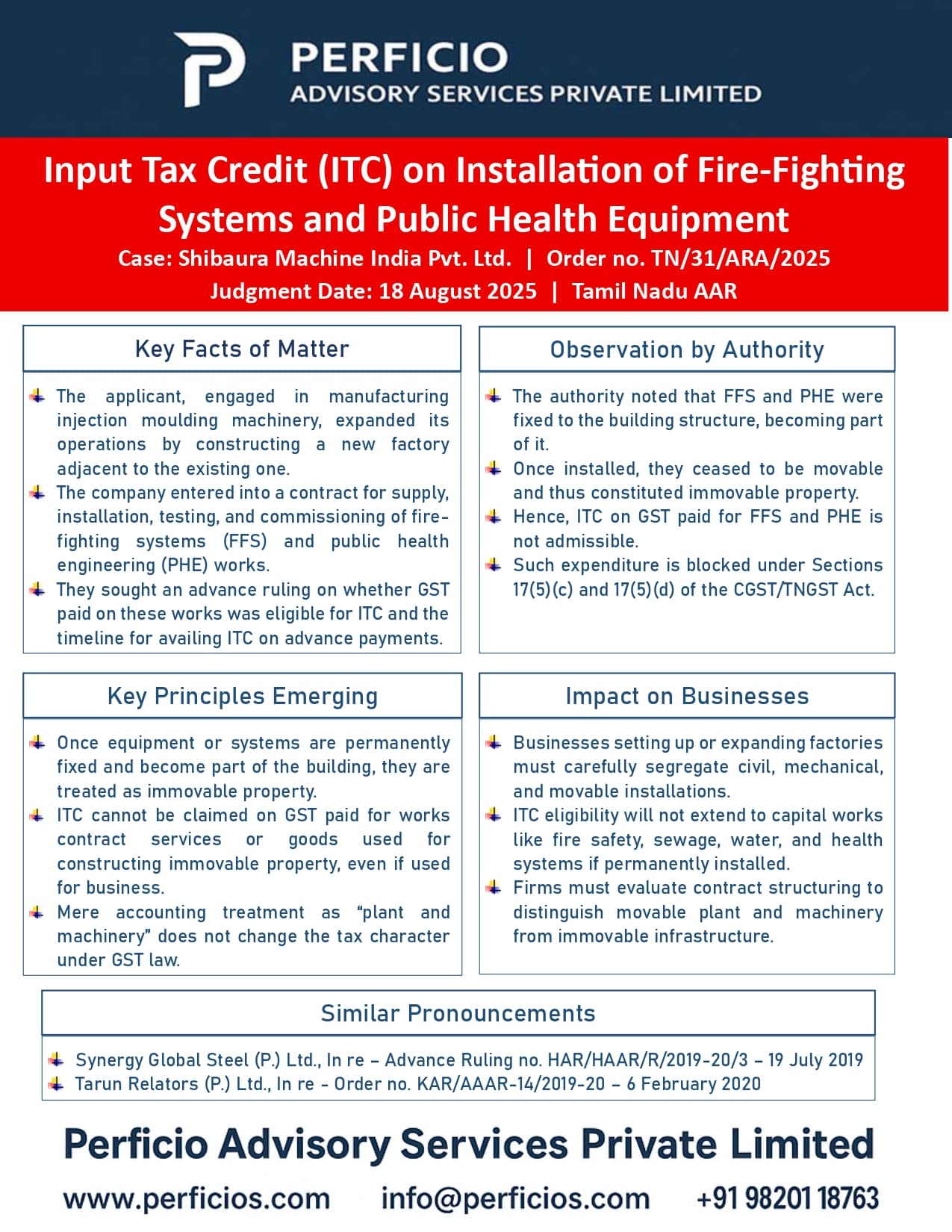

GST AAR Ruling - ITC on Installation of Fire-fighting Systems and Public Health Equipment

PERFICIO

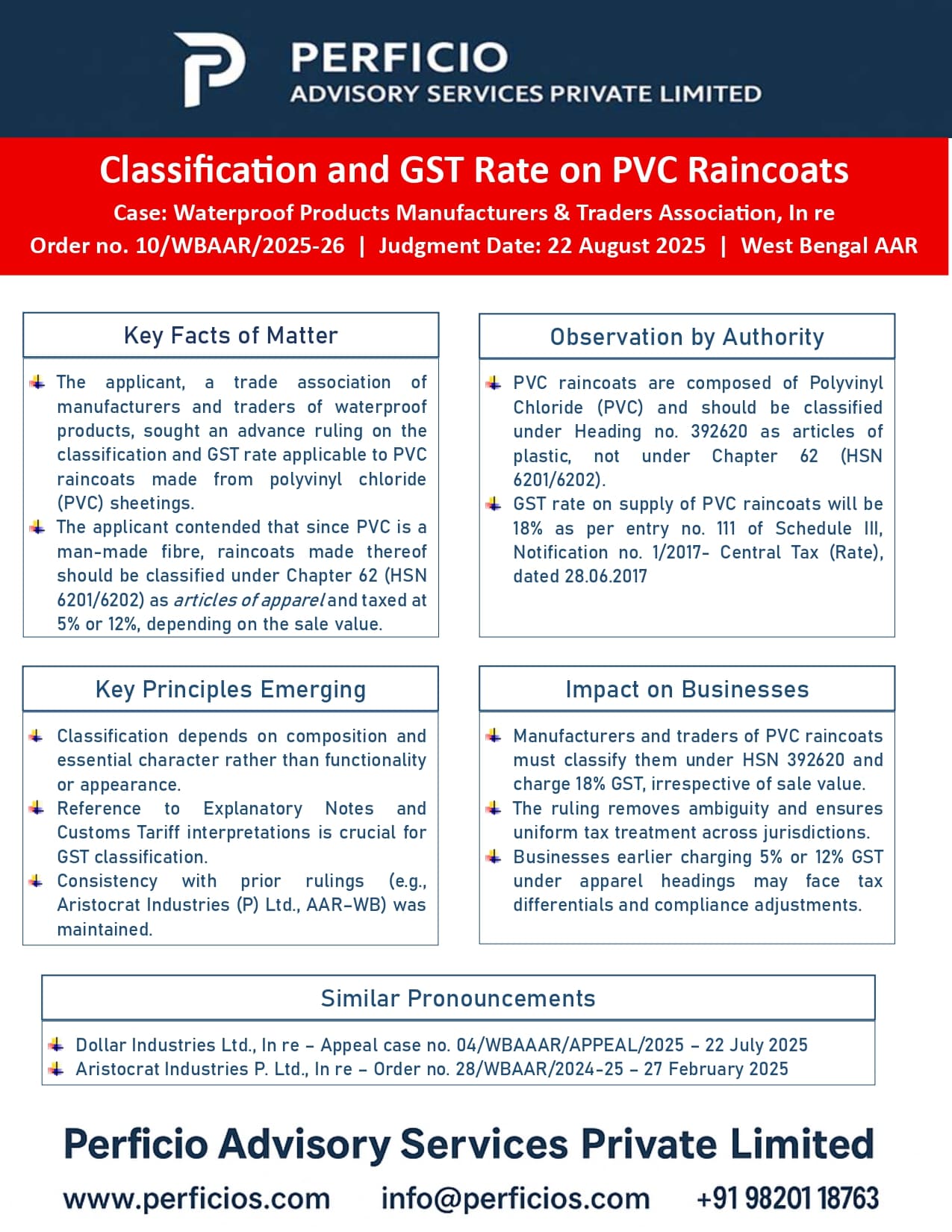

GST AAR Ruling - Classification and GST Rate on PVC Raincoats

PERFICIO

Tax Compliance Calendar - October 2025

PERFICIO

GST Update!! Changes in GST w.e.f. 1st October 2025

PERFICIO

GST Advisory - New Changes in Invoice Management System (IMS) effective from October Tax Period

PERFICIO

Tax Compliance Calender - September 2025

PERFICIO

GST Advisory - File your pending GST Returns before 01.10.2025

PERFICIO

Stay Compliant - File your MSME Return

PERFICIO

CBDT Update - Important Notification dated 08.09.2025

PERFICIO

Key Pillars of Centre's Proposed GST Reforms

PERFICIO

Special Rupee VOSTRO Account (SRVA) Mechanism

PERFICIO

Compliance Calender

PERFICIO

GST Updates

PERFICIO

Advisory - Handling inadvertantly rejected records on IMS

PERFICIO

CBDT Update

PERFICIO